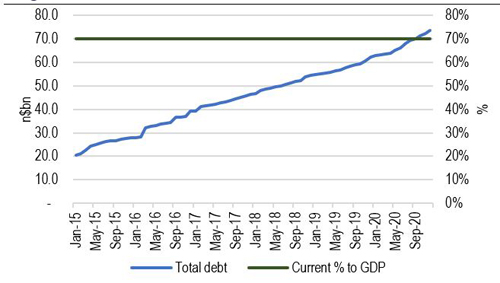

Namibia’s debt burden was expected to reach 70% of Gross Domestic Product (GDP) by the end of 2020 and then to increase further to 74% during 2021. This is a significant increase from 56% at the end of 2019 and nearly triples the debt level seen at the end of 2014.

According to Indileni Nanghonga, senior research and product development officer at the Agricultural Bank of Namibia (Agribank), the country’s debt servicing costs are a huge part of rising debt levels and is set to peak at 6% of GDP over the Medium-Term Expenditure Framework (MTEF) period.

“The absence of significant policy measures to arrest and ultimately reverse the debt accumulation will stifle the country’s ability to borrow in the medium-term. In addition, the expected increase in the debt-to-GDP ratio in 2021 can be attributed to a widening of the fiscal deficit, coupled with the maturing US$500 million Eurobond in November 2021 (5% of GDP),” said Nanghonga in Agribank’s economic outlook for 2021.

Nanghonga noted that in the 2020/21 financial year, total debt as a percentage of GDP is estimated to reach 70% and is projected to hit 83.1% at the end of the MTEF. This, she said, means that amid Covid-19, policymakers and investors will be confronted with a new reality, namely ‘heavy public debt’.

Said Nanghonga: “Although the Namibian economy is projected to mark a low-base effect recovery in 2021, policymakers face daunting challenges ranging from a public health crisis, management of rising public debt levels, as well as budget policies, central banking and structural reforms”.

In the outlook that was released last Friday, Nanghonga points out that 2021 is expected to remain under the shadow of the pandemic, despite increasing growth prospects as a result of vaccine rollouts.

The outlook states that on average, local economists expect the economy to moderately recover in the range of 1.5% (base case) and 3.0% (best case), stemming from a low base in 2020 and an increase in the demand of exports as major trading partners are projected to recover. However, delays in a global economic recovery could dampen Namibia’s growth prospects.

International ratings agency Fitch Ratings downgraded the South African economy to BB- from BB, with a negative outlook, reflecting high and rising government debt. Similarly, Moody’s downgraded the Namibian economy in December 2020 to Ba3 from Ba2, maintaining a negative outlook.

“The downgrade reflected further weakening in Namibia’s fiscal strength despite policy statements of plans to rein in the fiscal deficit. Both countries could see further downgrades in 2021 if the fiscal space remains constrained”, Nanghonga cautioned.

At the last downgrade, Moody’s warned that the implementation of government’s fiscal consolidation plans will invariably prove challenging in a low growth environment.

“Moreover, very large gross borrowing requirements continued over-reliance on short-term funding, point to a mounting liquidity risk. The negative outlook signals that an upgrade is unlikely in the near-term,” Nanghonga added.

She also warned that while most economies, including South Africa, rebounded in Q3 2020, Namibia’s economy still lingers into deeper recession.

The domestic economy contracted to 10.5% in Q3 2020, compared to a decline of 2.1% recorded in the corresponding quarter of 2019.

“The economy will gradually recover to 2.6% in 2021 and 3.2% in 2022 based on the assumption that most countries will open their economies, coupled with a gradual uptick in private consumption. While there is hope for an economic recovery, there still exists great uncertainty on a resurgent second wave of the pandemic and its impact on the economy. With growth prospects already weighed down by existing challenges, further economic and social interruption by Covid-19 could hurt the country’s fiscus and compromise economic recovery post-Covid-19,” reads the outlook.

Meanwhile, Agribank expects domestic inflation to remain low, hovering around 3% to 3.5% in 2021, owing to the risk of suppressed demand. However, she anticipates food inflation to increase as consumers seek to prioritise essentials.

“The subdued inflation gives bond buyers with long-dated maturities the ability to earn attractive real yields of around 5.0% to 9.0%, assuming inflation is anchored below 4% over the medium-term,” the outlook reads.

On the trade front, Namibia’s exports are expected to moderately increase in both soft and hard commodities as the world embarks on economic recovery from the devastating effects of Covid-19. Namibian imports, on the other hand, are expected to remain subdued due to low consumer confidence.

Commenting on the current account deficits, Nanghonga said: “There exists a trade-off effect in the trade balance as lower exports have been offset by reduced imports, keeping the current account deficit contained. This is expected to carry on in 2021 with more upside towards the export of hard commodities”.