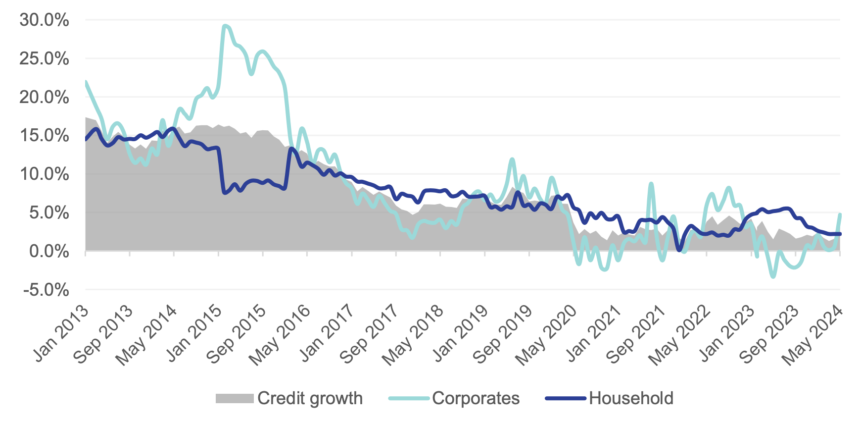

Despite higher interest rates that might have deterred credit demand, corporate appetite has actually increased as Private Sector Credit Extension (PSCE) for May reached the highest level recorded so far this year. This is the highest level since the 3.9% year-on-year (y/y) increase seen in March 2023.

“This implies that companies think now is a good time to invest, and that increasing credit availability will support future increases in the rates of economic growth,” local analyst Josef Sheehama stated in response to PSCE increasing to 3.2% y/y, up from 1.6% y/y in April 2024 and 1.5% y/y in May 2023.

“This could also happen if local businesses and entrepreneurs produce better, bankable projects, or if financial institutions change their internal models for assessing credit risk. Corporate borrowing decisions are influenced not only by investment patterns, but also by decisions made about the accumulation of assets and liabilities, and the kinds of financial instruments used to finance different business operations. A major factor in deciding whether to extend credit should be the cost of borrowing,” said Sheehama.

He added that household extension has stayed unchanged, which is linked to other costs such as fuel and electricity, amongst other commodities.

“The decline of consumer confidence, the depressing perspective for employment and income, and the possible inclination toward precautionary saving are all reasons behind the deceleration in the growth of household credit. Several factors have contributed to the trend of household credit extension, including rising unemployment, modest real income growth, a decline in consumer credit standing, and cautious lending from financial institutions,” Sheehama stated.

Stock brokerage Simonis Storm (SS) noted that growth in credit uptake was primarily driven by increased corporate demand, which increased to 4.7% y/y in May 2024 from 0.6% y/y in April 2024, and a contraction of -3.4% y/y in May 2023. This was as contrastingly, credit extended to households remained steady at 2.2% y/y for the third consecutive month, a slowdown from the 5.2% y/y recorded in May 2023.

By May 2024, domestic corporate debt stock stood at N$47 billion, with credit growth reaching 4.7% y/y, the highest since the 5.9% y/y recorded in October 2022. SS pointed out that “this growth was primarily driven by a substantial increase in the other loans and advances category, which saw a remarkable 17.7% y/y growth in May 2024, a significant turnaround from the -7.5% y/y in the previous year”.

Meanwhile, the central bank stated that the increased demand mainly came from the manufacturing and retail sectors, which it said reflects heightened business confidence and a push for financing operations and expansion.

SS stated: “This positive sentiment is supported by 1Q2024 GDP data from the Namibia Statistics Agency, which shows continued positive growth in the wholesale and retail trade sectors, despite the manufacturing sector posting negative growth for the third consecutive quarter. Instalment and leasing credit also saw robust growth of 29.1% y/y in May, up from 14.1% in May 2023, driven by demand from car rentals in the tourism sector”.

Moreover, the SS report highlights that mortgage loans for businesses declined by 3.8% y/y, which is slightly better than the 4.5% y/y decrease in May 2023.

SS stated this indicates a modest improvement in corporate real estate borrowing, but is still subdued due to high interest rates. Moreover, overdrafts fell sharply by 15.1%, worsening from the previous year’s -1.2% y/y, suggesting businesses might be managing cash flows better, or seeking alternative financing.

“Amid changing economic conditions, households’ debt stock increased by N$297.2 million on a monthly basis and N$1.5 billion on a yearly basis, although overall growth remains subdued. Mortgage loans saw growth of 1.5% y/y, reversing the 2.8% y/y growth seen in May 2023, partly due to the current high interest rate environment. Other loans and advances grew by only 0.2% y/y, a sharp decrease from the 17.5% y/y increase in the previous year, indicating more cautious borrowing behaviour among households.”

Furthermore, the Bank of Namibia stated that liquidity levels are anticipated to remain high in June 2024 due to corporates freeing up long-term deposits, driven by expected corporate tax payments. And while foreign reserves of N$55.6 billion indicates a month-on-month decrease of 1.2%. the central bank attributed this decline to higher payments to foreign governments, and increased outflows of customer foreign currency. Despite the marginal decline, these foreign reserves provide almost four months of import cover. This, SS stated, indicates Namibia’s capacity to manage external financial obligations and maintain stability in foreign exchange operations.