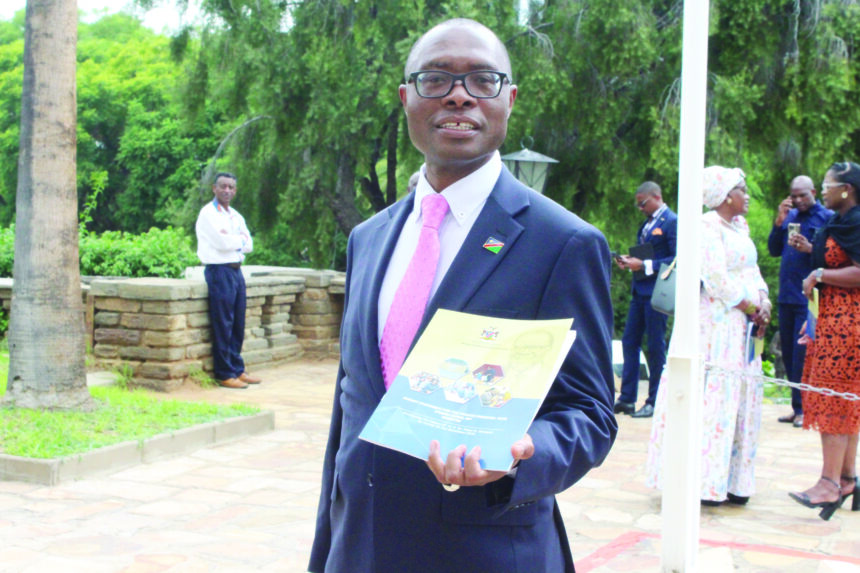

Minister of Finance and Public Enterprises, Iipumbu Shiimi, has said employees whose employers are not reimbursing the Pay As You Earn from the income tax amendments can claim their money from the Namibia Revenue Agency (NamRA) from February 2025.

A notice was issued by the minister for employers to reimburse employees for PAYE that was over-deducted from 01 March to August 2024. This followed Cabinet approval of the income tax amendments, which raised the tax thresholds for individual taxpayers from N$50 000 to N$100 000, effective from March 2024.

Speaking at the Government Information Centre on Thursday, Shiimi explained that the funds to be reimbursed have already been deducted from the PAYE monthly employee tax amounts due to NamRA. Therefore, instead of paying it to the revenue agency, a notice was issued for it to be paid directly to employees.

“This new arrangement, where we are saying employers must refund, was basically just a faster way of getting people their tax refunds earlier. Otherwise, employees would have to wait until next year,” he said.

Shiimi clarified that when the ministry announced the tax refund proposal, some employers were concerned about having to borrow additional money. However, he explained that this was a misunderstanding, as the money to be refunded is the deducted PAYE from employees’ taxable income.

“I would be very surprised if there is an employer who says, ‘I want to pay NamRA; I don’t want to pay you.’ Now, while you still have the tax credit… All we are saying is the employer doesn’t need to pay that tax to NamRA, because NamRA is saying you don’t have to do that, rather pay it to the employees. So, you are either going to pay that tax to NamRA or to the employees… What is there to lose?” he asked.

“If there is an employer who is unable to do this, I would like to know why, and I would like to have a conversation with that employer,” he said.

-Nampa