The Electricity Control Board (ECB) yesterday announced a 3.8% increase in bulk electricity tariffs for Non-Power Generation (Non-Power) consumers.

This approved increase is significantly lower than the 17.44% hike initially requested by the Namibia Power Corporation (NamPower).

The adjustment, approved following a review process, is aimed at balancing rising energy sector costs with the need to shield consumers from undue financial pressure.

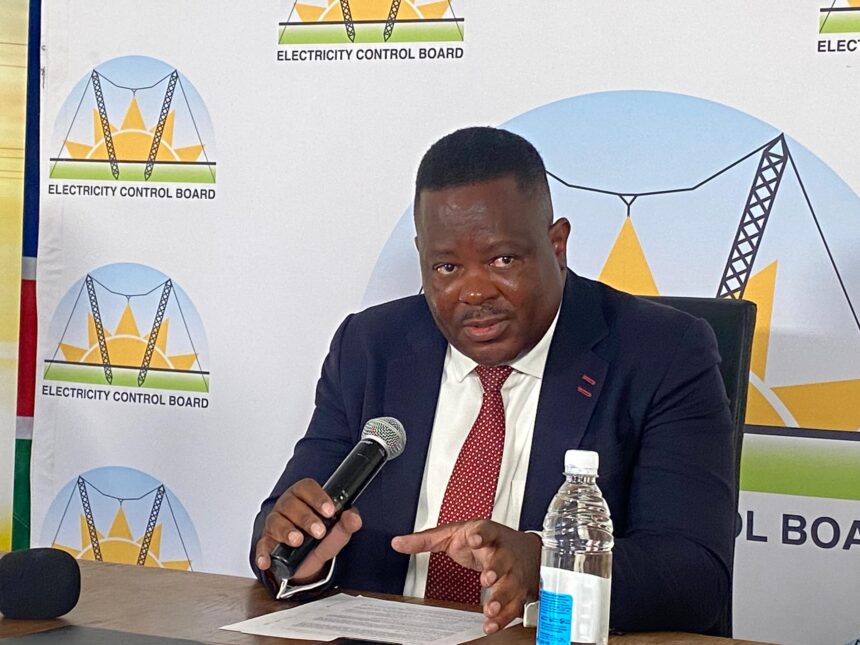

The ECB’s CEO Robert Kahimise said the revised tariff reflects a compromise under the board’s established tariff review methodology.

The approved hike will see the average bulk electricity tariff rise from N$1.99 to N$2.06 per kilowatt-hour.

Without intervention, tariffs could have climbed to N$2.33 per unit.

The ECB’s approved 3.8% increase will get financial support of N$283 million from the government.

“Regarding the impact of the approved bulk tariff on the economy, with the tariff increasing at 3.8%, below the current inflation rate of 4.2% (March 2025), it is expected that the tariff adjustment will have minimal impact on future inflation as well as on prices of goods and services. But it will slightly negatively impact GDP growth, as electricity cost is a component of the inflation calculation,” stated Kahimise.

“This decision considers the economic realities facing consumers, and the financial sustainability of the electricity supply industry,” he said.

He added that the regulator assessed various factors regarding the financial impact of the 3.8% tariff increase, including the government’s financial support of N$283 million.

Without the State subsidy, the tariff increase would have stood at 7.6%.

Considering these factors, Kahimise said “we confirm that NamPower will remain financially sustainable”.

The new tariffs take effect at the bulk supply level, influencing prices paid by regional electricity distributors and large power users.

Subsequent adjustments at the consumer level will depend on approvals from local distributors.

NamPower applied for N$8.8 billion.

However, it was reduced to N$8.1 billion, as NamPower’s revenue is based on the approved budgeted costs, volume (energy and capacity) and tariffs.

The 2023/2024 period saw an over-recovery of N$963 million, attributed to higher-than-projected generation from the Ruacana Hydropower Plant.

For the 2025/26 period, the ECB projected that 53% of the national demand will be supplied by local generation.

The remaining 47% will be met with regional imports.

In addition, the Ruacana Hydropower Plant remains the primary source of local generation, with performance dependent on the water flow of the Kunene River.

“It is important to note that, during the period of 2023/24, Ruacana generation achieved one of the best productions in years, generating 2 067 GWh due to favourable water management and water flow conditions,” Kahimise noted.

Moreover, with new solar and wind power projects booming in Namibia, Kahimise stated that these are beneficial additions to Namibia’s energy mix.

“We also expect two wind projects with capacities of 44 MW and 50 MW, totalling around 97 MW of wind energy, to be integrated into our energy mix, probably over the next 24 months. This is good for NamPower’s bulk supply, allowing for a mix between solar and wind,” he enthused.

He observed that wind power availability depends on wind conditions.

Similarly, when there is sun, producers can generate from solar and wind, thereby creating a hybrid input.

Kahimise said solar power plants scaling up on wind energy in the future will integrate it into the domestic energy mix to stabilise and strengthen Namibia’s energy portfolio.