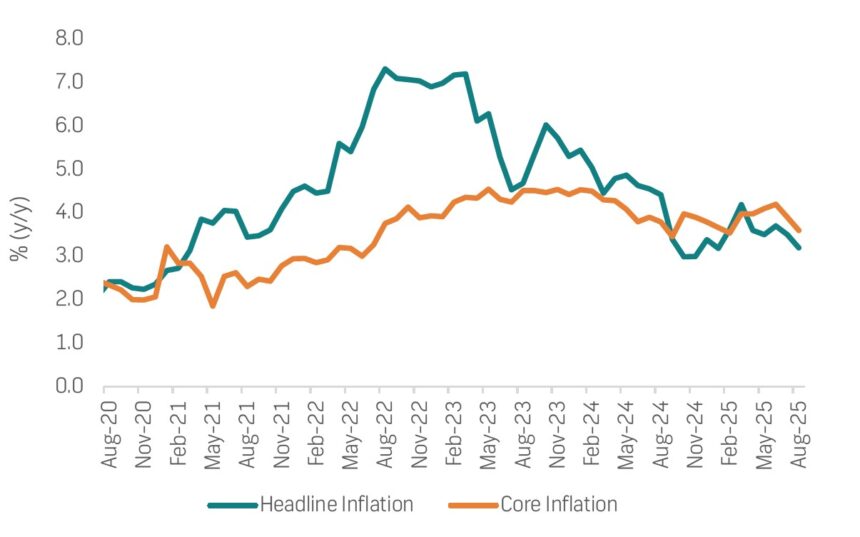

FNB Namibia analysts have revised their inflation trajectory marginally lower, now predicting headline inflation to reach 3.5% year-on-year (y/y) by December 2025. This is slightly lower than FNB’s earlier projection of 3.7% and comes as the latest Consumer Price Index (CPI) shows that headline inflation slowed to 3.2% y/y in August 2025, from 3.5% in July. This is below the bank’s August expectations of 3.5%.

According to FNB economist, Helena Mboti, this inflation expectation adjustment reflects lower-than-expected food prices, prolonged transport deflation, subdued domestic demand, and favourable currency dynamics amid a weaker US dollar.

“However, persistent pressures remain concentrated in food, housing and utilities, and alcohol, which together contributed +2.6-percentage points (ppts) to headline inflation in August (July: +2.93ppts). At the same time, transport continues to weigh on overall inflation (-0.2ppts), though base effects suggest this drag will fade in 2026. In the absence of new external shocks, we expect headline inflation to rise cyclically in early 2026,” Mboti indicated in the FNB’s CPI Review.

FNB also pointed out that core inflation edged lower, easing from 3.9% y/y in July to 3.6% in August, slightly below the 3.8% recorded in August 2024. “Nonetheless, core inflation remains above headline inflation and relatively stickier year-on-year, signalling that underlying price pressures remain and upward risks have not entirely dissipated,” it said.

Meanwhile, the continued downside surprise was largely driven by softer food price pressures following improved regional rainfall that boosted crop output.

In this regard, the FNB report notes that food inflation slowed from 6.1% y/y in July to 5.2% in August. However, in the report Mboti states that the overall moderation masks stickiness in several subcomponents, with meat and fish (+8.3% y/y), fruit (+16.0% y/y) and vegetables (+7.2% y/y) remaining elevated, offsetting declines in bread and cereals (+2.2% y/y), milk, cheese and eggs (+1.5% y/y) and other food categories (+3.6% y/y). Moreover, transport inflation remained in deflationary territory at -1.0% y/y in August, compared to -1.2% y/y in July and -2.2% y/y in June.

“While still negative, the gradual improvement points to stabilisation within the category. Transport therefore continues to act as a drag (-0.2ppt) on headline inflation, though the pace of contraction is slowing,” reads the report.

In addition, housing, water, electricity, gas and other fuels inflation softened to 3.4% y/y in August, down from 4.1% in August 2024 and 3.6% in July 2025. The moderation was mainly due to lower electricity tariffs, underpinned by higher domestic generation, but this was offset by higher water supply and sewerage costs, which accelerated to 4.0% y/y from 1.7% in August 2024.

“Looking ahead, we expect opposing pressures in housing to persist, with electricity generation likely to normalise over time while demand gradually lifts,” Mboti said.

In terms of services, inflation moderated from 3.8% y/y in July to 3.6% in August and remains above the 3.4% y/y recorded a year ago and higher than goods inflation.

Goods inflation fell sharply to 3% y/y in August, from 5.1% in the same month last year and 3.3% in July, pointing to easing pressures across both goods and services. On a month-on-month basis, headline inflation was broadly flat (0.1% month-on-month (m/m) in August), as softer food and transport costs were balanced by higher housing-related expenses, particularly rental payments and maintenance.