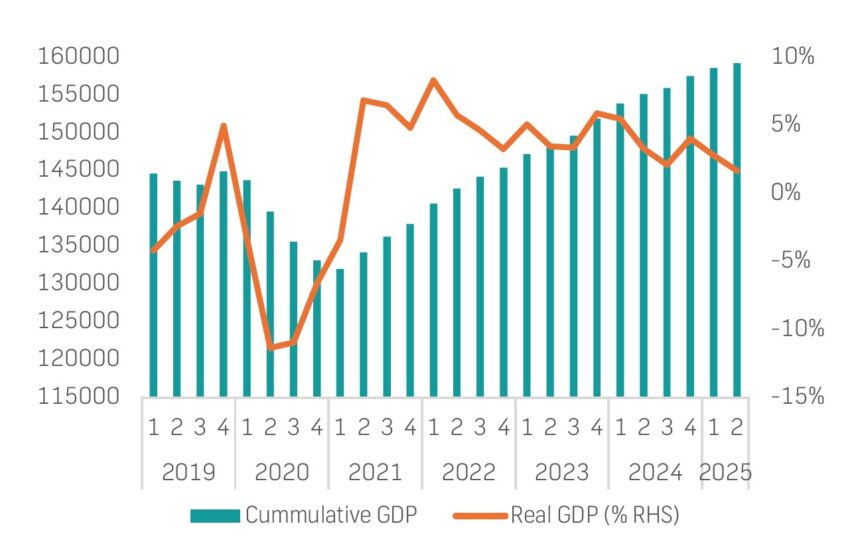

Rather sluggish real gross domestic product (GDP) growth for Namibia during 2Q25 at 1.6% year-on-year (y/y) may not be the results expected.

However, it may lay the foundations for more resilient, inclusive and sustainable expansion in the near-term.

The latest domestic GDP figures indicate a slowdown from 2.8% y/y in 1Q25 and 3.3% y/y in 2Q24.

In her most recent GDP analysis, FNB economist Helena Mboti pointed out that it is important to recognise that broad-based growth remains difficult to achieve given Namibia’s 55% broad unemployment rate, sticky inflation and rising housing costs, which continue to constrain private domestic consumption.

“In 1Q25, we maintained our GDP growth forecasts at 3.0% for 2025 and 3.4% for 2026, while cautioning that risks to the medium-term outlook were tilted to the downside. Those risks partially materialised in 2Q25, with Namibia’s average growth for the first half of the year now at 2.5%. Looking ahead, we expect cyclical improvements in agriculture to support both the primary sector and downstream meat processing,” reads FNB Namibia’s Q225 GDP Review.

FNB Namibia economists maintain the view that GDP growth could still reach 3% in 2025, underpinned by the cyclical turnaround in agriculture and manufacturing, as well as sustained optimism in the business environment, which they expect to continue to drive demand for services and tourism in 2H25.

“If this drag from households persists and outweighs the pull from foreign investment, growth could slow to around 2.2% in 2025, before regaining momentum above 3% in the medium term. Nonetheless, growth remains comfortably above the pre-pandemic average of -0.8% in 2019. Despite evident structural weaknesses, business sentiment on the ground remains broadly optimistic,” the FNB report reads. Meanwhile,Q225 figures show that Namibia’s primary sector remained weak, with agriculture contracting by -3.5% y/y, compared to a 2.2% expansion in 2Q24.

“This outcome reflects ongoing pressure in the livestock subsector, where marketing volumes dropped sharply as farmers restocked herds following heavy off-take last year, compounded by lumpy skin disease outbreaks. Crop output is expected to improve later in the year, but weak livestock marketing will continue to weigh on the sector until small stock numbers recover, likely from 3Q25 onwards,” FNB stated.

FNB also pointed out that secondary industries underperformed, stating the most notable drag came from manufacturing (-9.7% y/y vs +1.2% in 2Q24).

Meat processing fell sharply on weaker livestock supply, while diamond cutting and polishing contracted by 59.1% y/y, reflecting subdued global demand. “This reinforces Namibia’s structural dependence on diamonds in the downstream manufacturing base, with limited beneficiation from other minerals to cushion the drag in the short term,” FNB noted.

The report also points out that service sectors maintained growth but lost momentum.

This is as wholesale and retail trade slowed to 5.2% y/y from 9.1% in 2Q24, contrary to expectations of a stronger outcome.

Also weighing in, financial services firm Simonis Storm (SS) stated that the release of Q2 GDP figures showing 1.6% y/y growth confirms that Namibia’s economy is expanding, but at a slower pace than expected.

In a report shared by economic researcher Almandro Jansen, SS noted that domestic growth remains comfortably above the pre-pandemic average of -0.8% in 2019.

Despite evident structural weaknesses, business sentiment on the ground remains broadly optimistic.

“Together with the 2.8% y/y recorded in Q1, average growth for the first half of the year now stands at 2.5%, prompting us to revise our full-year 2025 forecast from 3.3% to 3.0%. This revision reflects both statistical realities and structural challenges, including the uneven performance across industries, persistent household demand weakness and the limits of how quickly fiscal and monetary support can translate into real activity,” the SS report states. The firm added that Namibia’s fiscal policy remains infrastructure-led, with government allocating N$4.3 billion towards construction, energy and water projects this year. “Execution, however, is critical. Procurement delays, weak implementation capacity and SOE inefficiencies continue to limit the conversion of capital budgets into real output. While headline allocations are supportive, delivery remains the key bottleneck,” SS cautioned.

While the services sector continues to provide the bulk of growth, SS expects tourism to expand 5.5% in 2025, generating N$4.6 billion in revenue, supported by targeted marketing campaigns and improved international connectivity.

The SS report adds that while Namibia’s offshore discoveries in the Orange Basin hold transformative potential, turning resource wealth into fiscal and developmental dividends will require major investments in roads, ports, pipelines, transmission networks and processing facilities.

“Equally important is the finalisation and consistent implementation of petroleum and local content policies, which remain in draft or consultative stages. Policy clarity will be vital to ensure investor confidence, domestic value capture and equitable resource management,” the SS report states.