Air travel growth in Africa is projected to hit 6% in 2026, exceeding the global average anticipated at 4.9%, slightly above the 5.2% expected this year. However, despite outshining the rest of the world in terms of air travel growth, the African aviation industry’s profit margins of 1.3% still lack the lustre as African airlines continue to face some of the world’s toughest operating conditions required to ensure profitability for this capital-intensive industry.

This challenging operating environment means African airlines will secure the smallest share of global industry profits due to these extremely thin margins.

The latest figures for the continent’s aviation were presented this week by the International Air Transport Association (IATA) during its outlook for Africa as part of the 2026 global industry forecast.

“Demand for air travel in Africa is rising faster than in many other parts of the world, but profitability is not keeping pace. With margins of just 1.3%, African airlines are capturing only a fraction of aviation’s economic value. Addressing the barriers that constrain growth is essential to ensure the region’s traffic expansion also delivers financial strength,” said Kamil Al-Awadhi, IATA regional vice president, Africa and Middle East.

Despite above-average demand, the financial outlook for African operators remains challenging. Of the US$41 billion in global net profit forecast for 2026 (3.9% margin), African carriers are expected to generate a mere US$200 million in combined profits, representing a 1.3% margin, which is the lowest of all regions. This equates to US$1.3 in profit per passenger, compared to a global average of US$7.9.

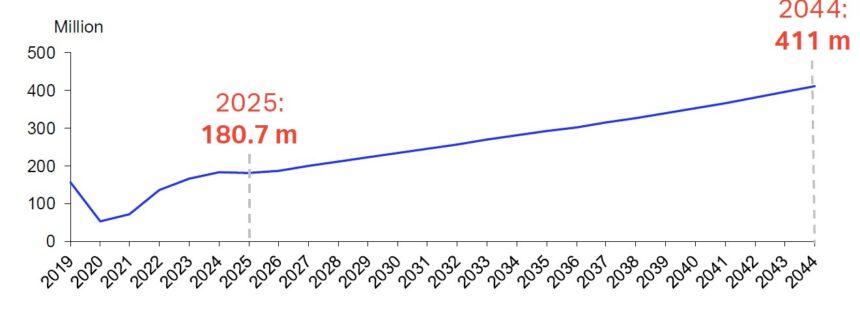

“Africa’s aviation potential is immense. With the third-fastest growth rate in the world over the next two decades, the continent could serve more than 400 million passengers annually by 2044. We’re already seeing encouraging steps—like improved visa openness and e-visa adoption—that support greater mobility and integration. But turning potential into performance requires action. Governments must treat aviation as a catalyst for development, not a source of revenue. That means reducing costs, improving infrastructure, and advancing market liberalisation through the Yamoussoukro Decision and SAATM (Single African Air Transport Market). With the right policy support, aviation can be a powerful driver of economic transformation across Africa,” said Al-Awadhi.

Meanwhile, IATA forecasts cargo demand at 2.6% globally in 2026, while Africa’s growth is expected to be slightly lower at 2%.

IATA elaborated why African airlines continue to operate in one of the world’s most difficult environments. Some of the key constraints for African aviation include; low GDP per capita (limiting demand and raising price sensitivity); high operating costs compared to global average (African fuel prices are 17% higher, taxes and charges are 12–15% higher, air navigation charges are 10% higher while Maintenance, insurance, and capital costs are 6–10% higher); and limited connectivity (only 19% of intra-African routes have direct flights).

IATA’s added that despite current challenges, Africa’s aviation sector has substantial long-term opportunity. Over the next 20 years, Africa’s market is forecast to grow 4.1% annually, reaching 411 million passengers, the world’s third-fastest growth rate. IATA noted that realising Africa’s potential will require focused reforms to reduce barriers, improve affordability, and expand connectivity.

IATA added that recent progress on visa openness on the continent is an encouraging example as five countries now offer visa-free entry to all African nationals (Benin, The Gambia, Rwanda, Seychelles, Ghana). This means that 28% of intra-African travel scenarios are now visa-free, up from 20% in 2016. Also, 26 African countries now offer e-visas, up from 17% in 2016.

“These improvements demonstrate momentum toward greater mobility, trade, and regional integration,” IATA stated.

The association called on African governments to work in collaboration with industry and pursue four priority actions. These are: Recognising aviation as a strategic economic enabler, not a revenue source, and to avoid excessive taxes and charges; Invest in efficient, scalable infrastructure without passing unsustainable costs to airlines and travellers; Facilitating market access and competition by advancing the implementation of the Yamoussoukro Decision and SAATM; and improving affordability and strengthen connectivity to unlock wider economic and social benefits. – ebrandt@nepc.com.na