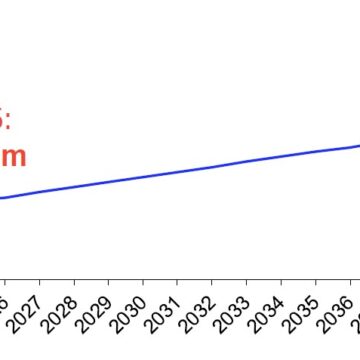

Air travel growth in Africa is projected to hit 6% in 2026, exceeding the global average anticipated at 4.9%, slightly above the 5.2% expected this year. However, despite outshining the rest of the world in terms of air travel growth, the African aviation industry’s profit margins of 1.3% still lack the lustre as African airlines...

Author: Edgar Brandt (Edgar Brandt )

Ineos goes all out for affordability and customer demand

The Ineos automotive brand is steadily gaining traction in the domestic market as it intensifies efforts to align operations with local customer needs. Known for its rugged, high-performance vehicles, the brand has been expanding its presence and refining its service approach to ensure that Namibian buyers experience greater convenience, shorter waiting periods and competitive value...

Airline industry profits stabilise despite supply chain issues

The global airlines industry is expected to achieve a combined total net profit of US$41 billion (about N$700 billion) next year, up from US$39.5 billion (just over N$674 billion) this year. This is according to the latest figures from the International Air Transport Association (IATA) that noted while the expected Net Profit would set a...

LDV Namibia secures top honours across key categories …outshines neighbouring countries at regional sales awards

LDV Namibia has cemented its position as one of the region’s growing automotive retailers after walking away with multiple top accolades at the LDV Annual Awards held last week in South Africa. The prestigious ceremony recognised outstanding performance among LDV dealerships across Namibia, Botswana, Zimbabwe and South Africa, making the achievements particularly significant for the...

MTC dividend reaches record N$722m

MTC’s latest financial results have enabled it to pay a dividend of N$722 million, the largest amount the company has ever paid to shareholders. Moreover, the company is set to pay out a final ordinary dividend of N$467.1 million (62.28 cents per share) by 6 February 2026. With digital growth at the centre of its...

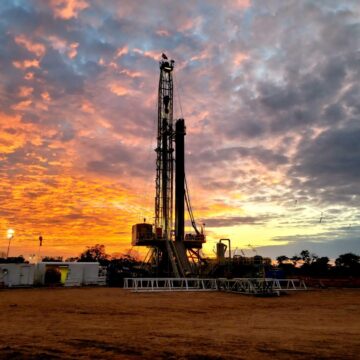

Production test is next for Kavango oil discovery

ReconAfrica and its joint venture partners, the National Petroleum Corporation of Namibia (Namcor) and BW Energy, will, within the coming months, assess the production capacity and then the commercial viability of their oil and gas discovery in the Kavango region. That assessment will determine the next steps for the recent discovery that marks one of...

Nekundi moves for mandatory dashcams …targets private, public transport

The Namibia Bus and Taxi Association (Nabta) supports a proposal for the mandatory installation of dashboard cameras in private and public transport vehicles. The proposal, made on Wednesday by works and transport minister, Veikko Nekundi, comes as Namibia continues to battle a sharp rise in fatal road crashes. Nabta secretary general, Pendapala Nakathingo, yesterday said...

De Beers pushes back against synthetic surge …on US offensive to reclaim natural diamond shine

The De Beers Group, in conjunction with the Namibian government, is moving aggressively to reclaim the global spotlight for natural diamonds, launching a high-profile charm offensive aimed at the world’s largest jewellery market, namely the United States of America. As part of the offensive to recapture significant global market share lost to synthetic diamonds, the...

Procurement scraps brand specific buying …says it distorts competition, leads to inflated pricing

It is imperative that all public entities desist, with immediate effect, from using specific brand names when advertising bids for any procurement. This Instruction Note was issued on 27 November 2025 by the Public Procurement Unit (PPU) in the finance ministry. “Public entities should note that the use of brand names or particular specifications exclusively...

Namport declares N$100m dividend

After recording another year of strong financial performance, the Namibia Ports Authority (Namport) last week declared a N$100 million dividend to its sole shareholder, the Namibian government. The dividend, announced last Thursday by Namport chairperson, Nangula Hamunyela, is related to Namport’s performance for the year ended 31 March 2025. “We have seen positive growth in...