The Namibian Competition Commission imposed a N$5 million fine on four entities in the cement industry for merging without notifying the Commission, and implementing the merger without approval. The entities fined are Fan Qingmei, Wang Zhongke, Hong Xiang Holdings LTD and Whale Rock Cement Pty (Ltd). The Commission noted that it is concerned about mergers...

Author: Edgar Brandt (Edgar Brandt )

Kia’s facelifted Seltos and Picanto make local debut

Kia’s facelifted 2024 Seltos and Picanto models have arrived at Namibian showrooms, and are sure to spark the curiosity of prospective owners with a host of new features and gadgets. The entry-level Kia Seltos, sporting a manual gearbox, starts off at N$473 000, while the top of the range 1.5 litre turbo GT version goes...

Tiggo 7 Pro Max 2024 the top Chery

Chery’s new Tiggo 7 Pro Max AWD offers a robust 1.6 litre turbo-petrol engine under the bonnet that produces a very impressive 145kW and 290Nm of torque. The performance of this remarkable engine is second to none, and easily gives vehicles with larger engines a good run for their money. Taking the Pro Max 7...

No plans to close stores – Thieme … O&L committed to job security

The Ohlthaver and List (O&L) Group does not intend on closing any retail outlets, and operations will continue as usual despite the group terminating a 27-year franchise agreement with massive South African retailer, Pick n Pay. This is according to the O&L Group’s executive chairman, Sven Thieme. “We remain committed to maintaining our presence in...

No job losses expected …as O&L pulls out of Pick n Pay

Union leadership representing most Pick n Pay Namibia employees does not expect any retrenchments emanating from the Ohlthaver and List’s (O&L) Group’s termination of its franchise agreement with the South African retailer. Penda Jakob, the secretary general of the Namibia Food and Allied Workers Union (Nafau) yesterday said official engagement will be guided by the...

HAN: Domestic tourism on rebound

The Hospitality Association of Namibia (HAN) said it is still premature to comment on the effect that Namibia’s new visa regulations will have on the domestic tourism sector. However, HAN CEO Gitta Paetzold noted there is no use denying tourism industry concerns. In a statement issued last week, she said the industry is concerned “mainly...

Global computer crash has minimal local impact

The Namibia Airports Company (NAC) on Friday issued a passenger advisory to confirm all scheduled flights to its airports were normal, despite a worldwide computer crash. The crash was caused by an antivirus software update by a company called CrowdStrike on Microsoft’s cloud computing service. “In the wake of the global information technology issue...

Debmarine gains ground in synthetic diamond battle …assures President of environmentally-sustainable mining

Environmental sustainability is a benchmark of marine diamond production for De Beers Marine Namibia (Debmarine). In fact, the company replaces 99% of the material it extracts off the seafloor where most of the sediment resettles within a few hours, and the finer sediment settles in a few days. Thereafter, the impacted environment returns to its...

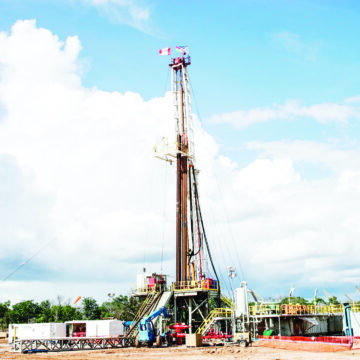

BW Energy buys stake in ReconAfrica

Canadian oil explorer Reconnaissance Energy Africa (Recon) and Norwegian-listed BW Energy have struck a deal for an onshore drilling campaign in northeastern Namibia. The deal means ReconAfrica is selling a 20% working interest in its exploration licence onshore Namibia, to BW Energy, in exchange for total potential consideration of US$141 million (about N$2.5 billion) According...

Hapulileís business acumen recognised in Nigeria

A young Namibian entrepreneur, Ndahafa Hapulile, was recently propelled to the forefront of African success stories when she was awarded a Royal African medal, and inducted into the Yoruba Royal Court in Nigeria. The award was bestowed on her as part of an initiative of the Royal African Young Leadership Forum (RAYLF), one of the world’s...