The Bank of Namibia, in collaboration with the Ministry of Industries, Mines and Energy, the Ministry of Justice and Labour Relations, and the United Nations, yesterday launched the ‘National Diagnostic of Informality in Namibia Report’. Speaking at the launch, deputy governor of the Bank of Namibia Ebson Uanguata, described the informal economy as a major...

Business

Energy sector must support development goals – Kröhne

Namibia must continue to plan, structure, manage and develop an energy sector that is capable of supporting and responding to domestic development aspirations, both today and in the future. In this regard, Namibian businesses should continue harnessing locally available resources, such as solar, biomass reserves and an excellent wind regime, for the benefit of all...

Massive N$2.1bn investment secured for Walvis Bay port

Standard Bank Namibia and RMB Namibia, in partnership with Terminal Investment Namibia (TIN), are playing a pivotal role in transforming the Port of Walvis Bay into a leading African transshipment hub. This landmark collaboration supports the terminal’s capital expenditure programme, which is expected to modernise terminal operations, enhance capacity and strengthen Namibia’s position as a...

Muinjo, Minnaar appointed at FNB Retail

FNB Namibia Retail has appointed Ziggy Muinjo as investment head and Carpio Minnaar as head of operations. Muinjo is a seasoned investment professional with more than a decade of experience across Namibia’s leading financial institutions. His career journey includes senior roles at the Government Institutions Pension Fund (GIPF), Rand Merchant Bank (RMB Namibia) and the...

SMEs’ spotlight with Pricilla Mukokobi – Traditional family business grows on social media

Lama Walaula, co-founder of Meme-Weedelela, a business based in Windhoek and well known for selling and renting Oshiwambo traditional attire, caters to weddings (eemhoko), iitala pepata ceremonies, and other cultural events. Their colourful outfits are popular not only among the Aawambo people but also among anyone who wishes to celebrate Namibian heritage. Walaula shared that...

SMEs’ spotlight with Pricilla Mukokobi – Amadhila sparks passion to business

Frieda Popyeni Amadhila, founder of Popyeni Jewels, has turned her love for gemstones and creativity into her livelihood. She holds an Honours Degree in Applied Biochemistry and a Certificate in Gemstone Cutting and Polishing. However, her path to success was not an easy one. After graduating, Amadhila struggled to find employment. Faced with the country’s...

Ankit Gems unveils new state-of-the-art facility

Antik Gems Namibia Diamond Polishing company on Friday unveiled its new state-of-the-art diamond polishing facility in Southern Industrial, Windhoek. Inaugurating the new facility, President Netumbo Nandi-Ndaitwah said that development signifies the growth potential of the Namibian economy. In her speech read by the Minister of Mines and Industry, Frans Kapofi, the President said the opening...

Housing market continues to show resilience …accelerated land servicing, access to credit needed

Namibia’s house price index shows that house prices grew by an average of 5.9% in the third quarter of 2025 (3Q25). This is slower than the 7.7% growth seen in the previous quarter (2Q25) and the 7.0% recorded in the same period last year (3Q24). Even with the slowdown, the housing market remains strong and...

ICT company opens training applications

Mach 10, an information and communication technology (ICT) company dedicated to driving secure digital transformation, has opened applications for the 2026 intake of its flagship XT Training Programme. As part of the Ohlthaver & List stable, Mach 10 aims to help businesses navigate an evolving digital landscape by utilising cutting-edge technology solutions. Mach 10’s training...

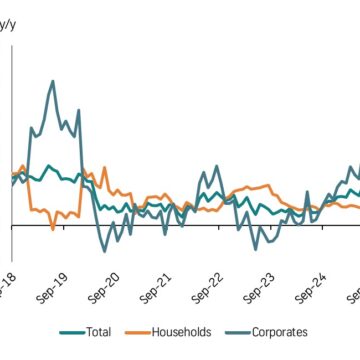

Corporates drive credit growth as PSCE rises

Namibia’s Private Sector Credit Extension (PSCE) growth is expected to remain positive, driven by corporate credit as household borrowing remains subdued. One of the key indicators of economic health, a growth in PSCE usually signals an increased demand for goods and services. “Credit growth rose to 5.9% year-on-year (y/y) in September 2025 from 5.8% y/y...