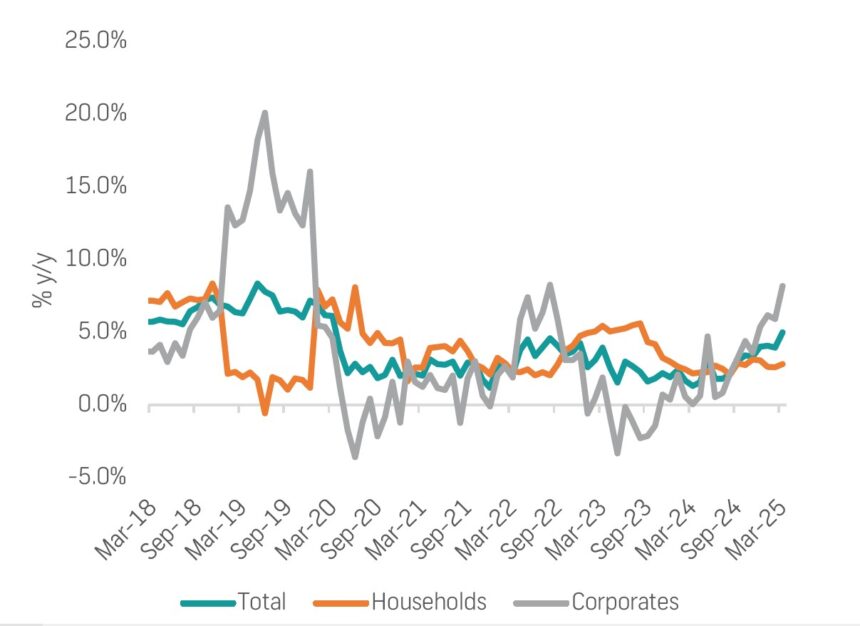

A notable acceleration in corporate credit uptake has resulted in domestic private sector credit extension (PSCE) growing by 5% year-on-year (y/y) in March 2025, up from the 3.9% y/y recorded in February.

This marks the strongest pace of credit expansion in five years.

Corporate credit constitutes approximately 50% of total domestic credit extended. This increased significantly to 8.2% y/y in March from 5.9% y/y in February. FNB noted that this acceleration was broad-based, with significant contributions from instalment and leasing, loans and advances and overdrafts.

The mining, manufacturing, tourism, financial services and energy sectors were the key drivers of this upturn.

In an analysis of the latest PSCE figures, FNB Namibia economist Cheryl Emvula and graduate analyst Ndateelela Amukuhu noted the latest figures indicate the highest annual growth in corporate borrowing since December 2019.

He highlighted a return in business confidence in the market.

By contrast, household credit growth remained subdued, registering a marginal uptick to 2.8% y/y in March from 2.6% y/y in the prior month.

“Across credit sub-categories, demand was generally robust, except for mortgages, which remained weak. Instalment and leasing rose notably by 17.1% month-on-month (m/m) in March, up from 15.7% in February. This translates to a solid 8.9% y/y growth. This reflects increased consumer reliance on asset-backed credit, particularly for vehicles. The trend suggests that both households and businesses are increasingly leveraging short-term credit solutions to navigate operational expenses,” the FNB analysts stated.

They noted that supporting this narrative, other loans and advances rose modestly by 0.35% y/y, driven mainly by the energy and manufacturing sectors.

“Overdrafts, which had contracted for 13 consecutive months, also turned positive, growing by 0.8% m/m, indicating an incremental easing of liquidity constraints with an increase in credit uptake mainly from the mining and financial sectors,” the FNB report states.

On the household side, a slight rise in total credit growth was supported by a stronger performance in secured credit segments.

This is as instalment and leasing rose to 14.5% y/y from 12.3% y/y in the previous month.

The FNB analysts pointed out that mortgages, which makes up nearly 66% of household credit, declined further by 0.6% y/y and 0.1% m/m.

“This suggests ongoing consumer caution, likely reflecting persistent pressures on disposable income, elevated unemployment levels and a high household debt burden that continues to constrain borrowing capacity,” FNB reported.

Meanwhile, stock brokerage Simonis Storm (SS) commented that the latest PSCE data suggests overall credit appetite is gradually recovering, supported by more confident business borrowing patterns and sustained instalment credit demand.

Weighing in on the most recent PSCE figures, SS analyst Almandro Jansen, stated that key sectors driving demand included mining, energy, tourism, manufacturing and financial services, indicating broad-based recovery in economic activity.