Namibia’s real GDP growth for the first quarter of 2025 dipped to 2.7% year-on-year (y/y) from 4.8% in the corresponding quarter of last year. While this is a notable slowdown in growth, it still marks the 16th consecutive quarter of domestic economic growth.

Local analysts pointed out that the latest figures, released this week by the Namibia Statistics Agency (NSA), are based on underperformance in the diamond mining and agriculture sectors that constrained economic momentum.

In an analysis shared by Christopher Freygang, Business Development Manager at PSG Wealth Namibia, strong non-diamond mining and services are expected to continue driving domestic economic output during 2025.

In PSG Wealth Namibia’s breakdown of the figures, the firm projects real GDP growth to ease to 3% in 2025 from 3.7% in 2024.

“We anticipate that the resilient services sector and robust non-diamond mining activities will continue to drive overall economic growth this year. In the short term, easing interest rates and inflation relative to 2024 are expected to continue supporting private consumption, benefiting service sectors such as retail and finance. Additionally, the government’s focus on human development spending will likely sustain growth in the education and health sectors. Tourism appears to be under pressure this year, weighed down by elevated geopolitical tensions, high airfare costs, and the introduction of new visa fees since April,” PSG noted.

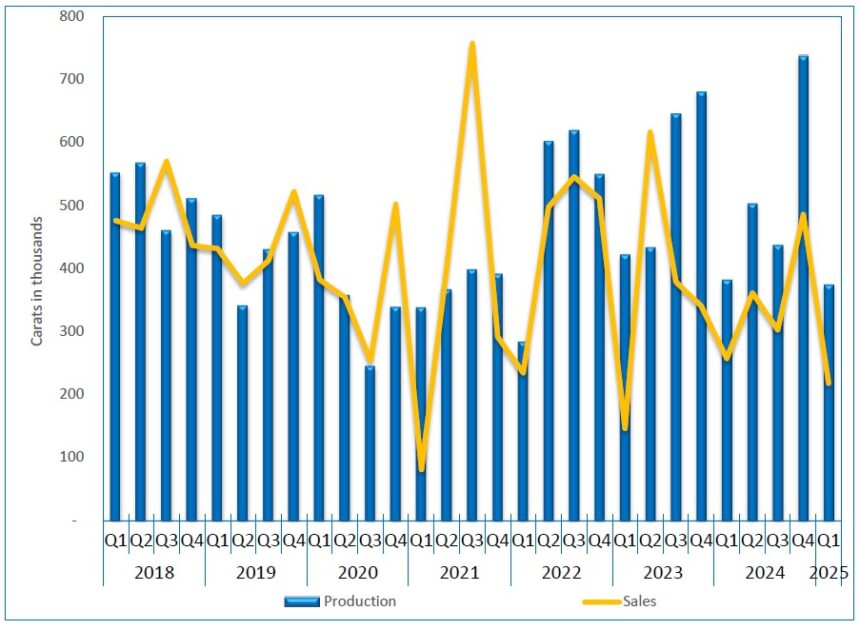

The firm continued that the outlook for the domestic mining sector remains mixed: “Depressed rough diamond prices are expected to keep diamond output flat or slightly lower in 2025. In contrast, uranium and gold production performed strongly in the first quarter and are likely to maintain momentum into the second quarter. However, uranium export growth may slow in the second half of the year due to earlier flood damage at the Langer Heinrich mine, while gold exports are set to decline with the planned end of open-pit operations at the B2Gold’s Otjikoto mine”.

Stock broking and investment firm, Simonis Storm (SS), pointed out the release of Q1 GDP figures showing real growth of 2.7% prompted the company to revise their full-year forecast from 3.8% to 3.3%.

“This revision isn’t just about numbers. It reflects a more measured view of the evolving risks and limitations across key sectors, and the realities of how quickly policy intentions can translate into economic outcomes. From where we stand, three forces are shaping this year’s outlook: a cautiously accommodative monetary environment, uneven sectoral momentum, and the state’s infrastructure-led fiscal stance”, SS analyst Almandro Jansen said.

He added that following 75 basis points rate cuts in 2024, it now expects a further 25bp reduction by the end of 2025, bringing the repo rate to 6.50%.

“This would offer breathing room for consumers and businesses alike, but transmission will take time. Liquidity is improving, but credit demand remains uneven. Inflation remains contained for now, but any shocks to food or fuel prices could shift that narrative,” Jansen stated.

Meanwhile, in its Q1 GDP report, NSA Statistician General Alex Shimuafeni, pointed out that the size of the Namibian economy during Q1 2025 was estimated at N$62.4 billion in nominal terms, which is an expansion of N$4 billion compared to the N$58.5 billion recorded in the corresponding quarter of 2024.

Shimuafeni said in real terms, economic activity grew by 2.7% during the first quarter of 2025, decelerating from the 4.8% growth recorded in the same quarter of 2024.

The performance, the NSA chief added, is mainly attributable to the tertiary industries that recorded a growth of 5.1% in real value added posted in the first quarter of 2025, compared to 4.8% growth recorded in the corresponding period of 2024.

“On a contrary, a downturn was witnessed in the secondary industries, recording a decline of 0.7% in real value added during the period under review, relative to a growth of 0.9% registered in the corresponding quarter of 2024. This performance emanates from the manufacturing sector that registered a 1.7% decline in real value added, compared to a decrease of 0.9% witnessed in the same quarter of 2024,” Shimuafeni stated.

The NSA figures also indicate that economic activities in Namibia’s primary industries slowed, witnessing a decline of 3.1% in real value added compared to a 5.9% increase recorded in the first quarter of 2024.

The NSA noted the poor performance is attributed to the ‘Agriculture and forestry’ and ‘Fishing and Fish Processing on board’ sectors, that registered declines in real value added of 20.1% and 8.7%, respectively. The decline in performance is reflected in the significant reduction in total animals marketed and a decrease in volume of fish landed.