Namibia’s economy grew by 1.9% in the third quarter of 2025, slower than the 2.1% growth recorded during the same period in 2024, according to the Namibia Statistics Agency (NSA). The latest figures show that while the economy continued to expand, the pace of growth eased as some key sectors struggled.

In nominal terms, the size of the economy increased to N$66.4 billion, up from N$62.6 billion in the third quarter of last year. NSA statistician-general and CEO Alex Shimuafeni said the figures show steady, though slower, economic activity during the period under review.“Growth was mainly driven by the services sector, also known as tertiary industries, which recorded a 4.1% increase in real value added. Although this was lower than the growth recorded in the same quarter of 2024, services remained the main engine of the economy,” he said.

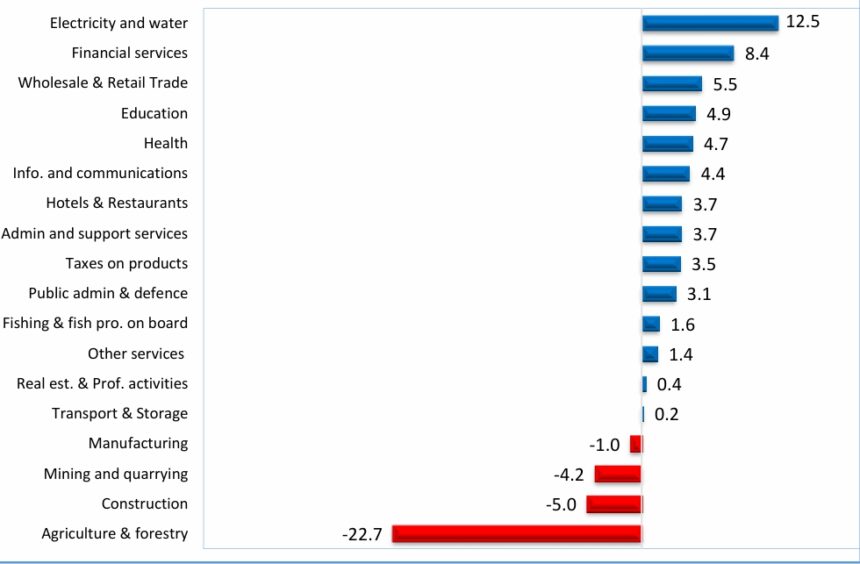

The electricity and water sector recorded the strongest performance during the quarter, posting a 12.5% increase in real value added. This marked a strong turnaround compared to last year, when the sector was in decline. The performance reflects improved supply and higher output in electricity and water-related activities. “Financial services activities followed as the second-fastest growing sector, expanding by 8.4%. Growth in this sector was supported by increased banking, insurance, and other financial activities. Wholesale and retail trade ranked third, with growth of 5.5%, reflecting improved trading activity and higher consumer demand,” he said. Other service sectors also showed positive results. Education grew by 4.9%, while health expanded by 4.7%. The information and communication sector recorded growth of 4.4%, supported by increased use of digital and communication services. Hotels and restaurants grew by 3.7%, indicating improved activity in tourism and hospitality during the quarter.

“The secondary industries recorded a modest growth of 1.2%, slower than the same period last year. Manufacturing and construction remained under pressure, limiting overall growth in this sector. However, strong performance in electricity and water helped prevent a deeper slowdown,” he said. In contrast, the primary industries continued to contract, declining by 6.9% during the quarter. Agriculture and forestry recorded the largest drop at 22.7%, mainly due to reduced livestock sales as farmers continued to rebuild herds. Mining and quarrying declined by 4.2%, affected by lower production of diamonds and other metal ores, except uranium. Construction also recorded a decline of 5.0%, reflecting weaker building and infrastructure activity.

“On the demand side, household spending showed clear improvement. Private final consumption expenditure grew by 5.1%, reflecting higher spending by households on goods and services. This growth suggests improved consumer confidence during the quarter,” he said. Government final consumption expenditure increased by 4.1%, supported by higher spending on public services and an increase in the number of public servants. Government spending continued to play an important role in supporting overall economic activity.Investment, however, remained weak. Gross fixed capital formation declined by 3.7%, mainly due to reduced investment in buildings and construction projects. The decline indicates continued caution by businesses in committing to long-term investments. External trade showed some improvement. Exports of goods and services increased by 4.7%, supported by higher export volumes. Imports grew marginally by 0.3%, helping to reduce the country’s external trade deficit, which is a positive sign for the economy.

The NSA also revised earlier figures, with second-quarter GDP growth for 2025 adjusted down to 1.3% from 1.6%. The agency said the revisions were due to updated data from key sectors, including construction, mining, manufacturing, agriculture, tourism, and fishing.

Shimuafeni stressed the importance of timely and accurate data from both the public and private sectors, noting that reliable information is essential for producing accurate quarterly GDP estimates. The Quarterly Gross Domestic Product (QGDP) figures help track short-term economic movements, while annual GDP provides a broader picture of long-term economic trends. -pmukokobi@nepc.com.na