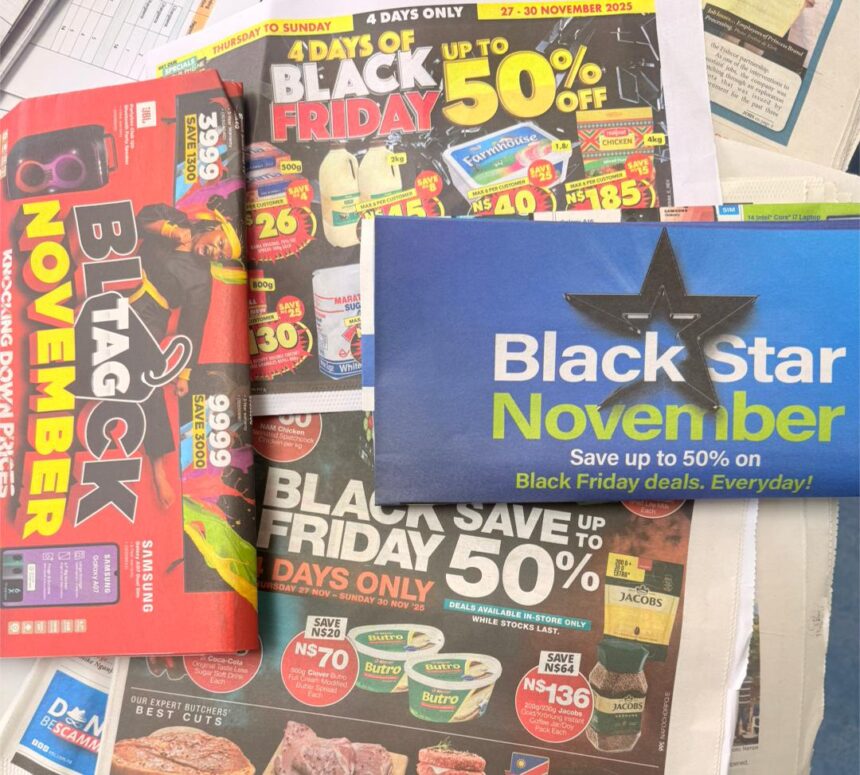

This year’s Black Friday is packed with incredible deals from various retailers, offering significant discounts on everything from electronics to home goods to fashion and more.

Black Friday happens every year on the last Friday of November, when many stores offer unbeatable specials that are usually available until the end of November.

Commenting on the annual sale, local consumer Marvellous Khaebes said Black Friday used to be limited to a few major retailers, mostly in Windhoek and a handful of chain stores, where discounts were modest. However, she said many customers did not fully understand the specials.

“Nowadays, Black Friday has become a full shopping season, with many stores running promotions for a week or even the entire month,” said Khaebes.

Mignon du Preez, group marketing, public affairs and sustainability executive, Old Mutual Namibia, commented that Black Friday excitement is everywhere.

“Stores are shouting about massive discounts, online deals are popping up on your feed, and everyone seems ready to grab something before it’s gone. But here’s the truth: a bargain isn’t a bargain if it leaves you broke or stressed about money,” Du Preez.

She added that, in Namibia, where the cost of living is climbing and festive season expenses are just around the corner, smart spending matters more than ever. Du Preez stated that Black Friday can be a great opportunity to save, but only if customers shop with a plan.

“Start with this simple question, Do I really need this? It sounds obvious, but impulse buying is the biggest trap during sales. Picture this, you walk into a store and see a fridge marked down by 35%. It feels like a steal. But if buying it means skipping your December savings or dipping into your emergency fund, that ‘deal’ could cost you more in the long run. A good rule? If it wasn’t on your list before the sale, think twice,” she said.

Meanwhile, Selma Kaulinge, spokesperson at Nedbank Namibia, said Black Friday has become a fixture on Namibia’s retail calendar.

“It’s no longer just an imported concept, but a cultural and economic event shaping consumer behaviour across the country. For businesses, it is a chance to boost revenue and deepen customer engagement. For consumers, it promises saving but also carries the risk of financial strain if approached without discipline,” said Kaulinge.

“Awareness of Black Friday is high, and electronics and appliances are still the most sought-after categories, followed closely by clothing and household essentials. Yet, the narrative is shifting as shoppers become increasingly cautious, prioritising value and necessity over impulse buys. Economic pressures, including rising living costs, interest rates, and inflation, have made consumers more strategic, focusing on pantry staples and practical goods rather than luxury splurges,” Kaulinge added.

She urged consumers to stick to budgets and avoid short-term loans for non-essential purchases.

The advice is clear: plan, verify deals, and resist the temptation of marketing gimmicks. Black Friday is often seen as an opportunity to stock up on essentials rather than indulge in discretionary spending.

“The most common Black Friday mistakes include poor planning, impulsive buying, and overspending on non-essential goods. Falling for marketing gimmicks like ‘limited time’ offers or bundle deals often leads to unnecessary debt,” she said.

-pmukokobi@nepc.com.na