FNB analysts expect inflation to ease further to 3.3% year-on-year (y/y) in June, supported by favourable fuel base effects and muted utility inflation following NamPower’s lower-than-expected 3.8% tariff increase.

This outlook is contained in FNB’s Namibia’s CPI Review for May 2025, by its economist Helena Mboti.

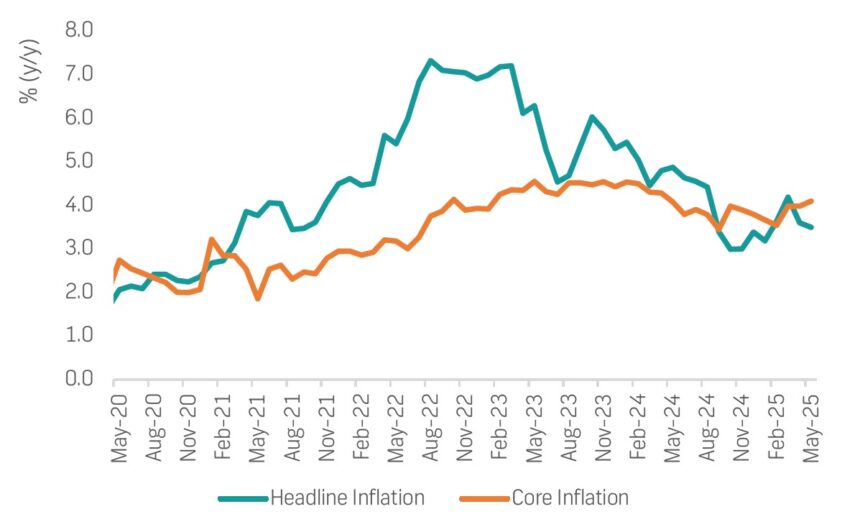

“With core inflation remaining elevated, we maintain our view that inflation will rise gradually through the remainder of 2025, albeit at a slower pace than previously expected, and in this regard, we expect inflation to end the year at 3.8% in December. However, risks remain tilted to the upside, particularly from the ongoing risk of global trade disruptions, volatile food prices, and persistent rent inflation, which may limit the pace of disinflation in 2025,” the economist states.

On a month-on-month basis, domestic inflation held steady at 0.2% and Mboti pointed out that a 0.4% month-on-month decline in housing costs, mainly due to seasonal water tariff reductions, was offset by increases in food (+0.7%) and alcohol and tobacco (+0.9%) prices.

Meanwhile, the review notes that core inflation rose to 4.1% y/y in May, up from 4% in April, and has remained above headline inflation since late 2024.

“This highlights entrenched price pressures in services, rentals, education, and alcohol, despite prices trending lower. This suggests that inflation may settle higher than 3.0%, indicating that recent disinflation may be temporary, particularly if transport prices are reversed,” the review states.

Meanwhile, the FNB report notes that regionally, Zone 3 (//Kharas, Erongo, Hardap, Omaheke) recorded the highest inflation at 4.0% y/y, driven by elevated food and housing costs. Zone 1 (northern and north-eastern regions) followed at 3.5%, while Zone 2 (Khomas) recorded the lowest at 3.1% due to transport deflation and softer service inflation.

Mboti surmised that while Zone 2 is home to a higher-income and more urban population, Zones 1 and 3 — where over 60% of Namibians live — face greater exposure to food and housing inflation amid lower wages and high unemployment.

“With more than half of employed Namibians earning less than N$5 000 per month, sticky prices in food, rentals and services, which make up 50% of the basket, continue to strain low-income households and the minority of breadwinners supporting large dependents,” the review says.

Namibia’s headline inflation eased further to 3.5% y/y in May 2025, down from 3.6% in April and 4.9% a year earlier. The moderation was largely driven by transport inflation, which fell to -1.3% y/y in May due to a steep drop in the operation of personal transport equipment subcategory (-3.3%).

As reported by the NSA, the sub-category reflected a sharp decline in fuel inflation from 13.7% to -7.8% y/y, and a slowdown in spare parts inflation to 1.4% y/y. As a result, transport’s contribution to the y/y headline inflation turned negative at -0.2points, compared to +1.2points in May last year.

The review notes that similarly, housing, water, electricity, gas, and other fuels inflation softened to 3.6% y/y in May (April: 3.8%), reflecting lower-than-expected utility costs and subdued demand for mortgage credit, partly offsetting upward rental pressures.

“These trends reflect ongoing livestock supply constraints as observed in the drop in the total number of cattle marketed in 2024, limited regional agricultural output, and elevated import costs,” the FNB review states.