United Africa Group (UAG) launched the United PayPoint yesterday. A new FinTech company was created to make financial services simple and accessible for people across Namibia.

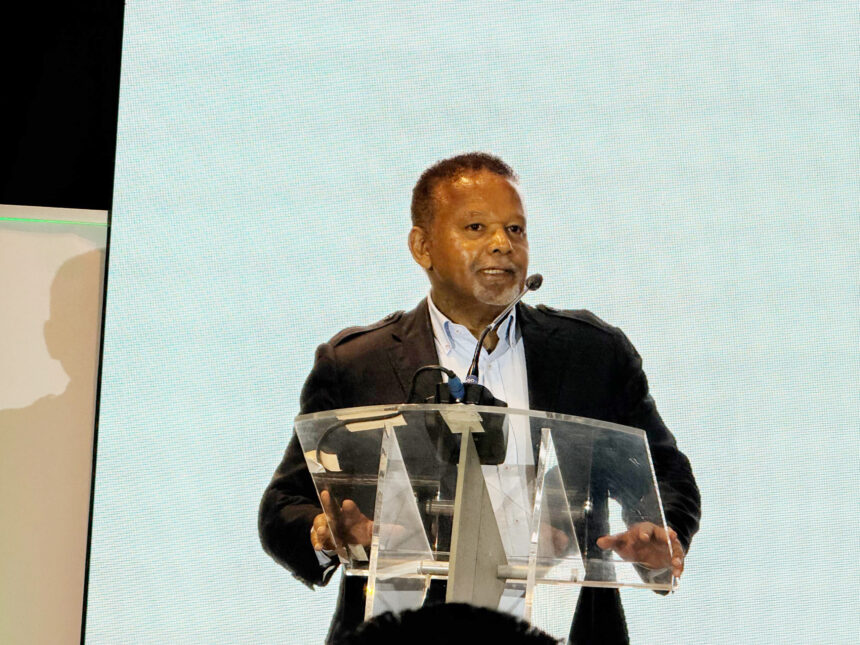

United PayPoint, is a fully licensed Payment Service Provider with authorisation from the Bank of Namibia to issue e-money and provide payment intermediary services, alongside a Micro Lending License from NAMFISA. These licenses affirm PayPoint’s compliance, credibility, and commitment to building a trusted financial ecosystem for all Namibians. UAG founder Haddis Tilahun said the company’s goal is to help both banked and unbanked Namibians take part in the digital economy.

PayPoint is an electronic payment and settlement platform that allows instant money transfers between people and businesses. The service is designed so that anyone, even those without a bank account, can use it easily and safely.

Tilahun explained that PayPoint offers several modern payment options, including point-of-sale devices for businesses, online payments, mobile payments and mobile wallets. All these services are connected through the new PayPoint mobile application, which allows users to send money, pay bills, buy goods and even earn income by becoming PayPoint agents. “To further support financial inclusion, PayPoint will also introduce microloans licensed by NAMFISA. These small loans will help people who may not qualify for traditional bank loans, giving them a chance to grow their businesses or improve their daily lives,” he said.

He further said that PayPoint aims to close the gap between those who have access to banking services and those who do not. He explained that PayPoint will give every Namibian the opportunity to take part in the financial system, no matter their background or location. “United PayPoint is not here to replace traditional banks, but to enhance and expand financial access. By offering mobile and USSD-based solutions, PayPoint ensures that even those without smartphones or formal banking relationships can participate in the digital economy,” he said.

United PayPoint is actively pursuing partnerships to broaden its service offering. A notable collaboration with KPI (KeyPlot Investments) will soon allow motorists in Windhoek to pay for parking using debit or credit cards, the KPI mobile app, PayPoint Wallet, and KP card. “With services set to launch in early 2026, United PayPoint is positioned to become a trusted companion in the daily life of Namibians, whether for students paying tuition, farmers selling produce, families sending money to each other, or businesses managing transactions,” he said.

Speaking on behalf of the deputy governor of the Bank of Namibia Leonie Dunn, Irene Venter acting director of National Payment System & National Surveillance Department said the central bank’s goal is simple. Building a payment system that is modern enough to inspire innovation, strong enough to protect consumers and inclusive enough not to leave anyone behind. “Innovation is the breach. Technology is the accelerator. Collaboration is the force that will carry us forward. Once again, congratulations to the United Paypoint team, on reaching the significant milestone,” she said. -pmukokobi@nepc.com.na