The domestic retirement funds industry is faced with a significant liquidity challenge. This is as recent data reveals a troubling decline in the industry’s ability to meet short-term financial obligations.

The industry’s liquidity ratio, which measures the adequacy of contributions to cover expenses and benefits, has dropped from 77% to 67.3% over the past year. The latest figures were released by the Namibia Financial Institutions Supervisory Authority (Namfisa) recently in their 2023 annual report. This decline indicates contributions are now insufficient to cover the fund’s ongoing liabilities, raising serious concerns about the sector’s financial health. A ratio of 100% means the contributions would be able to cover the payment of the costs and benefits, and a value of less indicates contributions received would fall short.

Liquidity is a measure of the ability of funds to meet their short-term financial obligations as they fall due.

In the retirement funds industry, monthly contributions play a crucial role in meeting the funds liquidity needs, as they are used to pay for the fund’s ongoing liability (benefits). Thus, it reduces the necessity to disinvest money from the market to pay for benefit claims when they fall due.

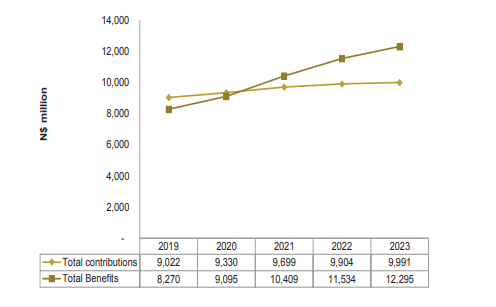

The report states that for the 2023 period, contributions increased by a modest 0.9%, while expenses and benefits surged by an alarming 15.4% during the same period.

This stark contrast highlights the growing strain on pension funds, as they struggle to balance incoming contributions with escalating payout demands.

“The industry could rely on investment income to cover the liquidity gap in 2023 as it did between 2018 to 2021. The industry’s liquidity is monitored by Namfisa to ensure timely corrective action is taken to avoid the realisation of risks to the viability of the pension industry.

On the other hand, as the clock struck midnight on 31 December 2023, a significant milestone was quietly celebrated in the world of retirement funds in Namibia.

The total membership of the retirement fund industry had grown by an impressive 3.6%, reaching a remarkable 374 949 members.

Among this expanding membership, close to 340 000 are active members, while the remaining, approximately 39 000 members, are pensioners.

Also, the total investments in the sector increased by 15.2% to N$235.8 billion as at 31 December 2023.

“The direct investments held by the industry increased by 15.6% to N$208.7 billion, and the value of insurance policies increased by 12.3% to N$27.1 billion as at 31 December 2023,” the Namfisa statistics indicate.

Meanwhile, total benefits paid in 2023 increased by 6.6% to N$12.3 billion, compared with the previous year. The growth in benefits correlates with continued withdrawals due to retirements and early withdrawals from members who resigned or were dismissed during the year. In addition, withdrawals due to retrenchments and deaths also contributed to total benefits paid.

In addition, retirement benefits paid continued to increase at rates higher than contributions.

Namfisa noted that benefits paid out by the industry have been growing for the past five years.

Therefore, the authority will continue its close monitoring of the industry to ensure prompt responses are taken to address potential threats to the continued payment of members’ benefits.

Unclaimed benefits

For the same period, the total unclaimed benefits balance decreased to N$218.7 million, down from N$229.1 million the previous year.

This decline is more than just a number, representing a heartfelt commitment to reconnecting members with their hard-earned benefits. Unclaimed benefits often tell a story of lost connections, where pension fund memberships ended up without receiving rightful benefits. These funds, which can significantly impact the financial well-being of individuals and their families, remained elusive for far too long.

However, the latest figures reveal an encouraging trend that more members and their dependants have been successfully traced and compensated.