Namibia’s trade balance worsened in March 2025, recording a deficit of N$2.7 billion, according to the latest Merchandise Trade Statistics Bulletin released by the Namibia Statistics Agency (NSA).

This marks a deterioration from the N$2.0 billion deficit recorded in February, though it reflects an improvement from the N$4.6 billion shortfall registered in March 2024.

Releasing the report, statistician-general and chief executive officer of the NSA Alex Shimuafeni said Botswana was Namibia’s top export destination for the month under review, while South Africa retained its position as the country’s leading source of imports. “Namibia’s total exports for March stood at N$10.1 billion, a slight monthly decline of 0.4%, while imports rose by 5.2% to N$12.8 billion, up from N$12.1 billion in February. The widening gap between exports and imports accounts for the increase in the trade deficit,” he said.

Meanwhile, mining products dominated Namibia’s export basket, with diamonds, non-monetary gold, uranium and copper leading the way. Fish was the only non-mineral commodity to make the top five exports’ list.

Re-exports fell by 3.8% month-on-month, but showed a modest annual increase of 4.1%. The re-exports’ category included copper products, diamonds, petroleum oils, nickel ores and fertilisers.

“On the import side, Namibia’s major purchases included petroleum oils, motor- vehicles for commercial use, inorganic chemical elements, nickel ores and civil engineering equipment,” Shimuafeni said.

In the food and beverage sector, the country was a net exporter of food items in March, registering a trade surplus of N$361 million. However, a trade deficit of N$183 million was recorded for beverages.

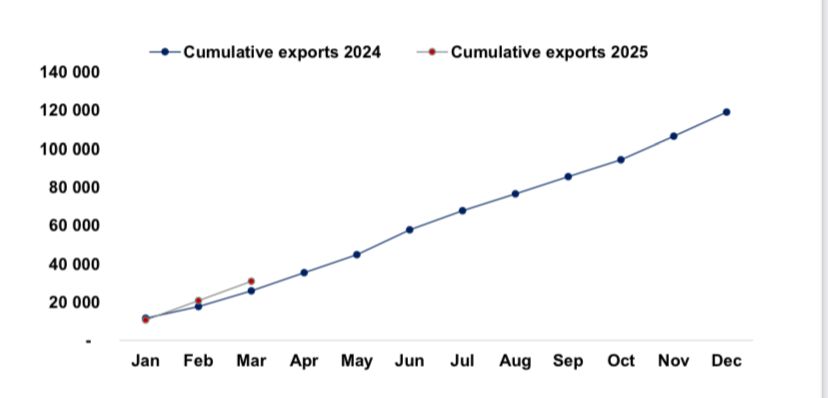

Cigarettes were highlighted as the commodity of the month. Imports totalled N$42.1 million, primarily sourced from South Africa and Switzerland. In contrast, re-exported cigarettes were valued at only N$0.1 million. “Despite the month-on-month trade imbalance, Namibia’s cumulative exports for March 2025 reached N$30.9 billion, up from N$25.9 billion over the same period in 2024, indicating a year-on-year improvement in export performance,” he said.

Shimuafeni emphasised the importance of monitoring trade trends to inform policy decisions aimed at enhancing Namibia’s export competitiveness, and addressing structural imbalances in the trade sector.

“During the month under review, export revenue declined by 0.4% to N$10.1 billion, compared to exports recorded in February 2025. Moreover, exports improved by 22.6% compared to N$8.2 billion registered in the corresponding month of 2024. March 2025 data shows that imports stood at N$12.8 billion, reflecting an increase of 5.2% month-on-month, and a decrease of a mere N$2 million year-on-year,” he said.

Moreover, Namibia’s top five export products in March 2025 were precious stones (diamonds), accounting for 20.1% of total exports, mainly destined for Botswana and the United States of America markets. Fish came second, accounting for 13.6% of total exports, destined mainly for the Spanish, Zambian and the Democratic Republic of Congo (DRC) markets.

Non-monetary gold occupied the third position, accounting for 12.4% of total exports, solely destined for South Africa. Uranium ranked fourth, accounting for 11% with the commodity mainly destined for China and France.

Moreover, the top five commodities imported into Namibia jointly accounted for 33.8% of total imports. Petroleum oils emerged at the top of the list of imported goods during the month under review, accounting for 20% of total imports. In second and third positions were motor- vehicles (for commercial purposes) and inorganic chemical elements gaining shares of 4.3% and 3.8% of total imports, respectively. ‘Nickel ores and concentrates’ ranked fourth on the list, accounting for 3.1%. Regarding economic blocs, the Southern Africa Customs Union (Sacu) emerged as the largest export market during March 2025, contributing 38.5% to total exports, followed by the Organisation for Economic Co-operation and Development (OECD) market accounting for 24.8%, while the European Union contributed 19.2% in third place. SADC, excluding Sacu (18.5%) and Comesa (17.5%) occupied the fourth and fifth positions. On the demand side, Sacu maintained its position as the largest source for Namibia’s imports with a share of 40.2% of the total import bill, followed by the OECD and BRIC (Brazil, Russia, India and China) with a contribution of 22.5% and 18.6%.