Canadian oil explorer Reconnaissance Energy Africa (Recon) and Norwegian-listed BW Energy have struck a deal for an onshore drilling campaign in northeastern Namibia. The deal means ReconAfrica is selling a 20% working interest in its exploration licence onshore Namibia, to BW Energy, in exchange for total potential consideration of US$141 million (about N$2.5 billion)

According to a Recon statement, the agreement aligns the company with strategic partner to explore both the Damara Fold Belt and Kavango Rift Basin with significant in-country expertise on oil and gas monetisation markets.

Through the agreement, Recon sold 20% of the working interest for Petroleum Exploration Licence 73 (PEL 73) to BW Energy.

This arrangement enables BW Energy to participate in two Damara Fold Belt exploration wells and a 3D seismic program, with an option to participate in two Rift Basin exploration wells over two-year period.

Recon and BW Energy signed the agreement for a strategic farm down of PEL 73. In connection with the Letter Agreement, BW Energy has agreed to a strategic equity investment in Recon for US$16 million (approximately N$290 million), pursuant to the brokered equity offering.

This (US$141 million) investment comprises US$16 million equity investment supporting the exploration program, US$45 million for bonus earned at declaration of commerciality (final investment decision), providing additional capital carry through to first production, US$80 million of production bonuses based on cash flow milestones achieved by BW Energy.

In addition, the joint venture structure preserves a 70% working interest in PEL 73 for ReconAfrica.

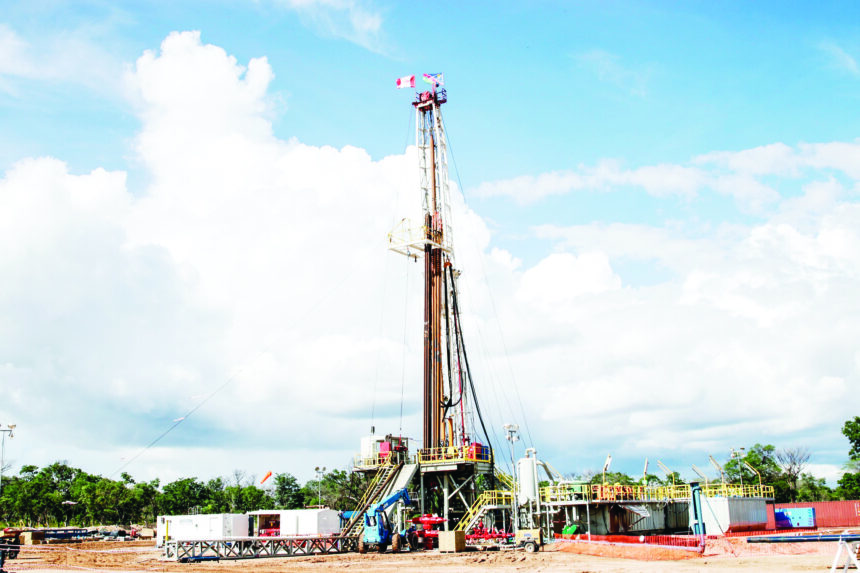

President and chief executive officer of ReconAfrica Brian Reinsborough commented: “We are delighted to welcome BW Energy as our partner in Namibia, where we plan to drill a multi-well exploration program, and acquire a 3D seismic program in the Rift Basin. Our farm-out joint venture process was thorough and comprehensive, which attracted significant interest from high quality companies of all sizes. BW Energy’s offer met our guidelines to ensure strategic alignment for a multi-well exploration drilling program, while retaining significant upside exposure on success. We continue to execute our strategic priorities set out last year with the company on track to drill a portfolio of opportunities in the Damara Fold Belt and the Kavango Rift Basin. The first well, Naingopo, is currently drilling, and is supported by BW Energy whose high-quality technical team will add significant value to the execution of our forward exploration plans. This partnership provides ReconAfrica with a strategic partner with a high-quality technical and operational team which compliments ours along with a shared view to expand the oil and gas potential in Namibia. Additionally, we look forward to continuing to work closely with Namcor, the Ministry of Mines and Energy in Namibia for the benefit of all parties, including Namibia and its people.”

BW Energy’s chief executive officer Carl Arnet commented: “The transaction will enable BW Energy to expand its footprint in a strategically-important energy region and further our position as a leader in Namibia’s development towards energy independence. The data and insights gained through ReconAfrica’s exploration campaign will further our understanding of the geology and petroleum system in Namibia, and help de-risk planned exploration and development of our Kudu licence.”

Moreover, Recon has stated its intention to apply, in the near future, for a dual-listing on the Namibian Stock Exchange, alongside its existing listing on the Toronto Stock Exchange in Canada, to further broaden global exposure.

Meanwhile, Recon also entered into an agreement with Research Capital Corporation as the lead underwriter and sole bookrunner, on behalf of a syndicate of underwriters, in connection with an overnight marketed public offering of units. Recon noted that the net proceeds from this offering will be used for exploration activities, working capital and general corporate purposes.