In 2025, Namibia’s economy saw significant changes that affected households, businesses, and investors. Inside Business closely followed these developments, focusing on interest rates, inflation, and real-world economic impacts. The Bank of Namibia (BoN) oversees the repo rate, which is used to manage inflation and promote economic growth. In 2025, Namibia’s energy sector is undergoing significant...

Business

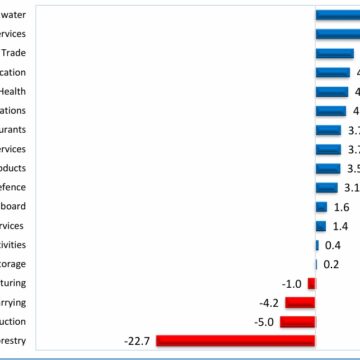

Electricity, services drive economy as growth slows in Q3

Namibia’s economy grew by 1.9% in the third quarter of 2025, slower than the 2.1% growth recorded during the same period in 2024, according to the Namibia Statistics Agency (NSA). The latest figures show that while the economy continued to expand, the pace of growth eased as some key sectors struggled. In nominal terms, the...

NBFI sector grows steadily in Third quarter of 2025

The non-banking financial institutions (NBFI) sector continued to grow in the third quarter of 2025, supported by positive financial market conditions. According to the third quarter report released by the Namibia Financial Institutions Supervisory Authority (NAMFISA), chief executive officer Kenneth Matomola, the sector’s total assets rose to N$528.2 billion as of 30 September 2025. This...

Outapi youth gain welding skills for Namibia’s energy boom

Pricilla Mukokobi Lissony Njembo As Namibia enters the oil, gas, and green hydrogen industries, it faces an immediate need for skilled technical workers, particularly artisans capable of supporting large-scale industrial projects. In response, youth from Outapi in the Omusati region began a five-day specialised welding training program at the Nakanyale Vocational Training Center on Monday. ...

EIF approves grants worth over N$3.7m

The Environmental Investment Fund (EIF) has approved 26 institutional grants totaling morethan N$3.7 million, benefiting individuals and institutions across priority sectors nationwide. Of the approved grants, eight projects are youth-led, and 11 are led by women. EIF spokesperson Romeo Muyunda said the funding supports a wide range of beneficiaries and interventions. “The funding supports a...

Opinion – How turnaround strategies work

When a business hits distress, recovery is not about bold statements, but about disciplined, practical action. In previous articles, we explored how business turnaround begins, with early warning signs, structured planning, and clear collaboration. But what happens after the plan is agreed? That is when recovery truly begins. When a business is in distress, time,...

FNB equips car guards for festive season

First National Bank (FNB) Namibia has handed over bibs and hats to 100 car guards operating under the Swakopmund Municipality, reinforcing efforts to enhance safety and visibility in public areas ahead of the busy festive season. The handover took place in Swakopmund at a time when the coastal town experiences an influx of holidaymakers, increasing...

Whale Rock Cement, MUN ink wage increase

Whale Rock Cement (trading as Cheetah Cement) and the Mineworkers Union of Namibia (MUN) have reached a new wage agreement for the 2025 and 2026 financial years. The agreement signed on 12 December 2025 aligns with the Recognition and Procedural Agreement between the two parties. Under the agreement, all employees in the bargaining unit will...

NSX recognised at Global Banking and Finance Awards

The Namibia Securities Exchange (NSX) has been recognised as the Most Innovative Securities Exchange, Southern Africa 2025 under the Innovation Awards category of the Global Banking and Finance Awards 2025, an international awards programme conducted by Global Banking and Finance Review. According to a statement from Tjiundja Kazohua, Chief Regulatory Officer at the Namibia Securities...

Public supports Starlink Licence Application

The Communications Regulatory Authority of Namibia (CRAN) said it has received strong public support for the Starlink telecommunications licence application. Mufaro Nesongano, Executive for Communication and Consumer Relations at CRAN, said although the application is still under consideration, the majority of the submissions received are in favour of the telecommunications company. He said that by...