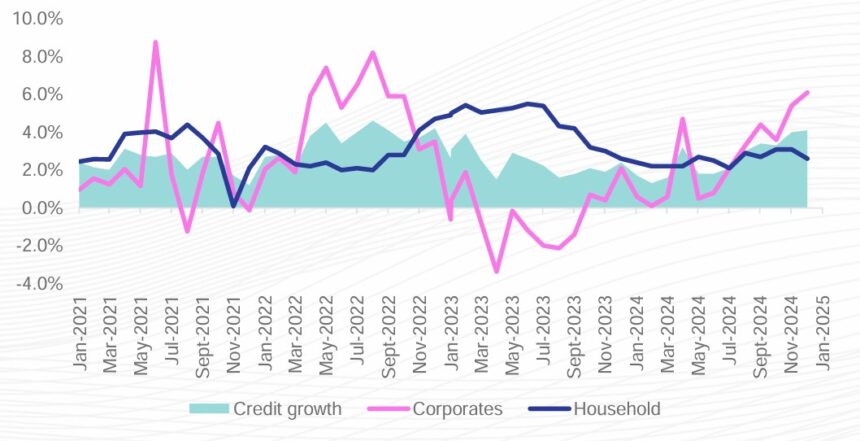

Economic analysts expect Private Sector Credit Extension (PSCE) growth to remain sluggish as Namibian households show limited demand for long-term credit, while corporate lending continues to expand. This is as PSCE growth slowed to 3.9% in February 2025, down from 4.1% in January, but up from 1.7% a year ago.

Providing an analysis of the latest PSCE figures, FNB Namibia economist Cheryl Emvula and graduate analyst Ndateelela Amukuhu noted that corporate credit showed strong growth at 5.9%, up from 0.6% a year ago, while household credit remains steady at 2.6% year-on-year (y/y).

Breaking down the figures, the analysts indicated that other loans and advances grew at 8.9% (y/y), while instalment and leasing credit remained weak at 15.7% (y/y). However, mortgage credit remained weak at 0.5% (y/y), and overdraft lending, though improving , was still in contraction at -2.7% (y/y) in February.

Meanwhile, as PSCE growth for February 2025 decreased marginally, it improved from the 1.7% witnessed 12 months ago.

“The improvement is due to growth undertaken by corporate extension growth of 5.9% y/y in February 2025, a significant increase from the 0.6% growth experienced in February 2024. Household credit growth remained subdued, with growth of 2.6% y/y in February 2025, and slightly ahead of the 2.4% witnessed in February last year. Other loans, advances and instalment and leasing credit continued to post growth at 8.9% y/y and 15.7% y/y, respectively in February 2025,” the FNB analysts stated.

They further pointed out that overall mortgage credit continued to anchor down growth, with credit extension growth of 0.5% y/y witnessed in the period under observation.

“Both households and corporates are seeing a slow uptake in the credit type, as economic pressures continues. Overdraft lending rebounded from a deep contraction of 8.6% y/y in January 2025 to -2.7% y/y in February as businesses continue to settle balances,” the FNB credit report states.

Meanwhile, household PSCE growth continued to stagnate for the fifth consecutive month in February 2025 at 2.6%, some 1.7 percentage points (ppts) lower than the 4.3% y/y growth recorded in the same period last year.

“We expect overall credit demand from households to remain subdued as mortgage extensions (accounting for 66.58% of the loan book) continue to anchor down total PSCE growth. Likewise, households’ indebtedness and unemployment levels remain elevated, which hampers creditworthiness and access to credit,” FNB added.

Commenting on the figures, Simonis Storm (SS) analyst Almandro Jansen pointed out that PSCE growth has reached the highest level since early 2023. “The continued upward trend reflects a gradual yet tangible improvement in risk appetite, particularly within the corporate sector. In contrast, household credit demand remains lacklustre, reinforcing the divergent credit dynamics between businesses and consumers,” reads the SS report.

The SS report added that on a sequential basis, credit growth picked up from 3.3% y/y in November and 4.0% y/y in December, supporting the view that financing conditions are becoming more accommodative, at least for corporates. “This trend aligns with broader macro-economic improvements, including stronger business confidence and incremental economic recovery,” the SS report stated.

It continued that the mining, construction and tourism sectors saw notable increases, indicating businesses in capital-intensive industries are actively deploying credit for expansion and capital investment.

“This reinforces the improving business sentiment that has been cautiously building over recent months. Despite this, overdraft lending contracted sharply, falling by 8.6% y/y, suggesting that firms remain focused on cash flow optimisation and short-term liability reduction, rather than relying on revolving credit lines,” SS stated.