Although domestic vehicle sales increases experienced in July this year did not continue in August, the commercial vehicles’ segment has shown a positive trend in recent months, boosted by various macroeconomic factors.

In its analysis of the latest vehicle sales figures, stock brokerage Simonis Storm (SS) noted that as further interest rate reductions are anticipated, the cost of borrowing is expected to decline, which may stimulate economic activity, even though immediate improvements in vehicle affordability may be limited.

“Since the decline in new vehicle sales began in April 2024, expectations are rising that the new vehicle market could see improvement for the remainder of the year due to favourable economic conditions,” SS stated.

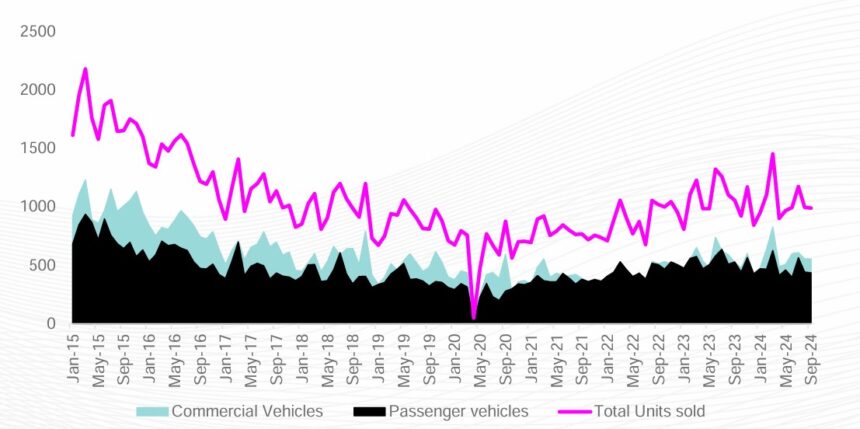

In September 2024, vehicle sales reached 988 units, which was still a continued decline in the units sold for the past two months.

Out of these units, 978 were sold to dealerships, 10 to rental agencies, and none to government.

SS further noted that vehicle purchases by rental agencies have significantly declined over the past two months, with sales dropping from 141 units in July 2024 to just 10 units in September 2024.

“While the third quarter of 2015 holds the record for the highest vehicle sales (5 200), the third quarter of 2024 saw a total of 3155 units sold, representing a 7.5% decrease, compared to the same period last year, which recorded 3411 units sold,” SS added.

The overall vehicle market was largely supported by sales in the commercial vehicle segment.

In September 2024, a total of 553 commercial vehicles were sold, comprising 56% of total vehicle sales, marking two consecutive months of decreasing units sold.

SS stated that the sales in the commercial category can primarily be attributed to light commercial vehicles, which made up 48.8% of total vehicles sold for September 2024.

Meanwhile, passenger vehicles, constituting 44% of total vehicle sales, experienced a decrease in September 2024, with 435 new units sold, marking the second consecutive month of decline.

“This reduction in passenger vehicle sales could reflect consumers’ hesitancy due to prevailing future interest rate decisions. Despite these economic challenges, the continued sales activity may still indicate underlying consumer confidence, and suggest the potential for sustained momentum in the vehicle market as broader economic conditions stabilise or improve,” the SS report states.

Moreover, within the light commercial vehicle segment, the Toyota Hilux maintained its position as the most popular choice, with 255 units sold.

In the medium commercial vehicle category, the Mercedes Benz Sprinter was the leader with 7 units sold, while the Hino500 series led in heavy commercial vehicles.

Extra heavy commercial vehicles were dominated by the Volvo FH, and the Mercedes Benz Bus emerged as the preferred option among buses.

For passenger vehicles, the Toyota Fortuner (60) remained a top choice among consumers, with the Toyota Corolla Cross (54) and Polo Vivo (48) trailing behind.