Domestic inflation is expected to remain elevated but relatively contained. In its latest consumer price index analysis, FNB stated it expects transport inflation to stay muted, amid subdued demand and ongoing geopolitical uncertainty.

However, the analysis compiled by FNB economist Helena Mboti expects housing and utilities’ inflation to remain high due to an expected increase in electricity tariffs in 2025. “In 2024, the government subsidised NamPower’s proposed 8% electricity tariff hike, allowing electricity costs to remain unchanged for the year. As a result, NamPower is likely to propose a larger tariff increase in 2025 to recover deferred costs.

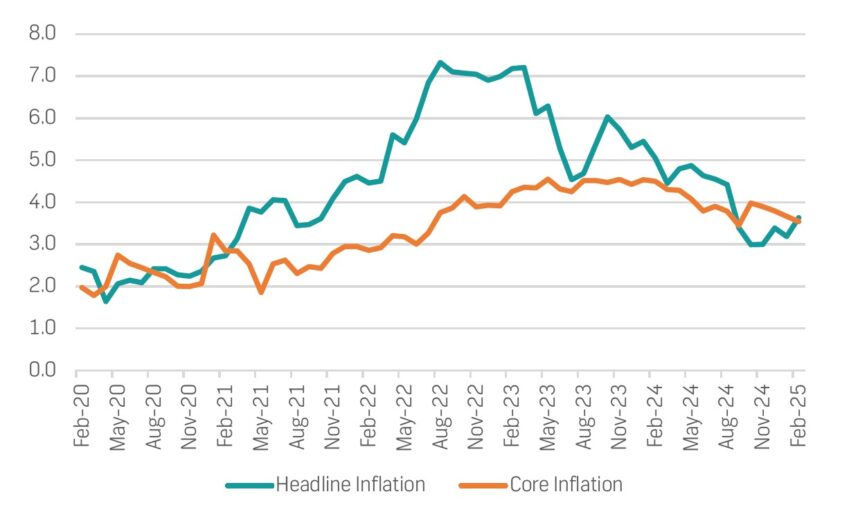

“We also expect continued pressures from house prices. Therefore, while the March figures reflect a notable upward surprise, we continue to project inflation to remain anchored around 4% in 2024. However, we have marginally increased our April 2025 forecast to 4.2%, and revised our 2025 average inflation forecast to 4.0%, up from 3.8%,” FNB stated.

Mboti noted that headline inflation rose unexpectedly to 4.2% year-on-year (y/y) in March 2025 from 3.6% in February, above the bank’s forecast of 3.9%. She said the upside surprise was primarily driven by a sharper-than-expected increase in alcohol prices. Strong contributions from food as well as housing and utilities’ categories were broadly in line with expectations. Food inflation remained the largest contributor to headline inflation at +1.23ppt. Prices rose marginally to 6.2% y/y from 5.9% in February, pointing to continued price pressures in the agricultural sector. Similarly, the housing and utilities’ category edged up to 3.8% from 3.6%, largely due to higher electricity and gas costs, contributing +0.92ppts to headline inflation. On the interest rate side, FNB expects the Bank of Namibia’s Monetary Policy Committee (MPC) to keep the repo rate unchanged at 6.75% at its upcoming meeting on tomorrow.

This would maintain the 75bp policy differential with the South African Reserve Bank (SARB).

The SARB held its repo rate steady at 7.5% in March 2025. “While it continues to guide toward a terminal rate of 7.25%, we forecast a lower endpoint of 7.00% in South Africa, with two additional rate cuts of 25bps each. This view is underpinned by expectations of subdued inflation and soft domestic growth, though external risks, particularly trade and currency volatility, may complicate the monetary policy path.

“Idiosyncratic geopolitical tensions between the US and South Africa have further weighed on the rand, which has depreciated 3.1% year-to-date against the US dollar, currently ranking as the fourth worst-performing emerging market currency. In light of persistent external uncertainty, modest domestic demand and manageable inflation dynamics, we expect the Namibian MPC to maintain a cautious stance and keep the repo rate unchanged at 6.75% on,” Mboti stated. The FNB report adds that gross domestic product growth was recorded at 3.7% y/y in 2024, outperforming the bank’s forecast of 3.5%.

This is underpinned by stronger-than-expected growth in the secondary sector, while domestic demand remained largely subdued. “Despite improving economic momentum, weak disposable incomes continue to weigh on household credit growth, with Public Sector Credit Extension remaining concentrated in corporate lending. Foreign exchange reserves remain robust at N$63bn, equivalent to 4.2 months of import cover, though we caution that upcoming Eurobond maturities and potential trade disruptions could place pressure on external buffers in the second half of this year,” she added.