Government is making the necessary preparations to ensure the country is able to meet its Eurobond obligations on 29 October 2025. This is according to finance ministry spokesperson Wilson Shikoto, who stated Namibia is ready to repay its largest single-day debt maturity in the country’s history.

Bonds are investment securities where an investor lends money to a company or a government for a set period in exchange for regular interest payments. Once the bond reaches maturity, the bond issuer returns the investor’s money.

Governments usually sell bonds for funding purposes, and to supplement tax revenue.

The US$750 million (N$18.2 billion at current exchange rate) Eurobond was issued on 29 October 2015 at a coupon rate of 5.25%. In line with the bond covenants, the interest is paid on a bi-annual basis over the life of the bond.

“Accordingly, government will transmit at least N$3.5 billion during FY2024/25, and some N$2 billion in FY2025/26 of the Southern African Customs Union receipts to the sinking fund to place us in a position to retire two-thirds of the Eurobond (US$500 million) at maturity,” said Shikoto.

The remaining one-third of the bond (US$250 million) will be refinanced utilising the most cost-effective instrument in the next financial year, cognisant of the prevailing high interest rate environment and the need to manage debt servicing costs.

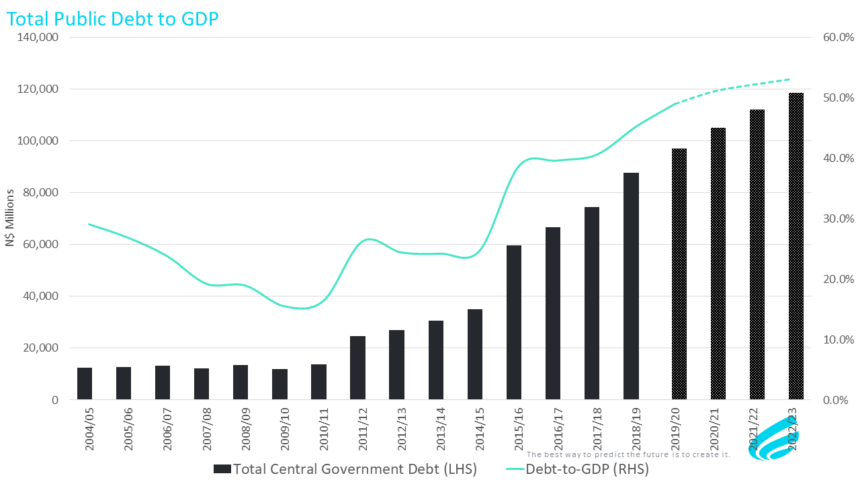

Government has been running relatively high budget deficits over the past 16 years, which resulted in a need to raise additional funding to close the gap between revenue and expenditure.

Shikoto further indicated that the Eurobond was used to fund the country’s budget deficit in FY2015/16 and FY2016/17.

The bond proceeds benefited both the operational budget and capital projects in the development budget over the two fiscal years, including the construction and upgrading of various roads, land servicing nationwide, sanitation and electrification in rural and peri-urban areas, school and clinic construction, railway network development, and the construction of the Neckartal Dam, among others.

“The issuance of the Eurobond enabled the government to fully meet the budget financing requirements over the two financial years. As such, the funds were spent in line with the intended purpose,” he stated. As this challenge continues, government regularly issues bonds in the domestic market to raise funding. Although the budget deficit has narrowed significantly to 3.2% during FY2024/25, and is expected to average around 3% over the Medium-Term Expenditure Framework (MTEF) period, there is still a financing gap.

As customary, the envisaged deficits will be financed primarily through bond issuances in the domestic markets combined with financing from other sources such as development finance institutions (DFIs) and international bond issuances as necessary.

According to the central bank, domestic government debt increased by 1.44% to N$119 billion in June 2024 compared to N$117.3 billion in May.

This represents an increase of N$1.7 billion month-on-month and in addition, domestic debt rose by 10.18% on a year-on-year basis.

Finance minister, Iipumbu Shiimi, last year showed his concerns with the public debt servicing bill. This is as the debt portfolio rises, coupled with prevailing tight financial conditions.

In his national budget statement in February 2024, he said government is committed to redirecting part of the increase in revenue towards the sinking fund to manage the rollover risk and contain increases in future debt service obligations.

“This will ensure that we minimise a potentially significant future drain on resources that are desperately needed for infrastructure development, poverty reduction and combating climate change, among others,” said the finance minister.

Government budgeted N$12.8 billion to meet debt servicing obligations in FY2024/25, equivalent to 14.2% of revenues and 4.7% of GDP.

The debt servicing metrics, although stabilising, remain above the desired benchmark of 10% of revenue.

Senior economist Omu Kakujaha-Matundu said defaulting on the Eurobond is not an option.

“Defaulting on repayment obligations will put Namibia in the bad books of lenders. It corrodes confidence in the economy, and could foreclose your access to international finance. As lenders, it will force Namibia to be classified as high risk, and they will lend to you at high coupon/interest rates in the future,” he said.

Kakujaha-Matundu said borrowing at high interest rates will add salt to the wounds, as Namibia is already spending billions in debt servicing.