OMUTHIYA – The Namibia Revenue Agency has urged taxpayers to report companies which do not pay tax so that they can investigate and take action against them.

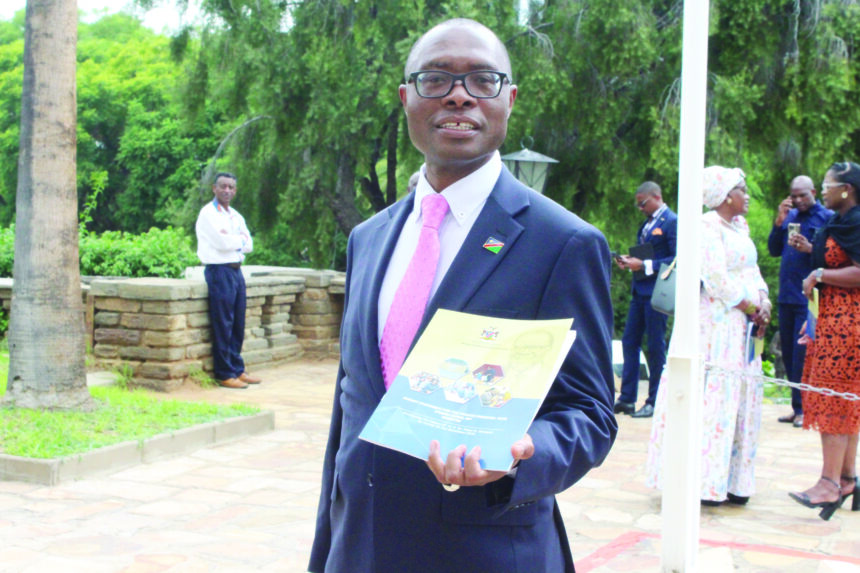

The request was made by NamRA facilitator Simson Shivolo during the small and medium enterprises (SMEs) stakeholders’ meeting held at Omuthiya on Wednesday.

He made the statement after the deputy director of the planning division in the Oshikoto Regional Council, Priscilla Lyakwata, enquired about some foreign nationals allegedly operating businesses in Namibia without paying tax.Shivolo, however, cautioned against false allegations, saying companies’ tax affairs ultimately remain confidential.

He further urged taxpayers to utilise the Integrated Tax Administration System (ITAS), as he said it helps to improve service delivery to them.

He noted that the self-service facility is convenient and operates 24 hours, seven days a week. Shivolo also encouraged the community to pay tax as it helps to support the government in generating revenue, social development programmes, and infrastructure development.

The aim of the meeting was to strengthen the relationship between SMEs and NamRA by emphasising the importance of taxpayer compliance, and offering support to enhance business operations.

-Nampa