An increase in the prime lending rate at commercial banks has direct implications for the debt-servicing cost of domestic households. This places additional strain on already vulnerable households severely weakening their ability to service both interest and capital repayments. This is substantiated by the growth in household debt.

According to the financial stability report for 2022 released by the Bank of Namibia (BoN) and the Namibia Financial Institutions Supervisory Authority (Namfisa), households’ debt servicing costs almost doubled from 2020 to 2022.

Last month, BoN increased the repo rate by 25 basis points, from 7% to 7.25%, which brought the prime lending rate to 11%. However, BoN governor Johannes !Gawaxab said while he is aware of the public’s suffering in light of increased bond and loan repayments as well as the escalating cost of food, he noted it is not compulsory for banks to increase their lending rates.

The repo rate is defined as the lending rate offered by a central bank to commercial banks for its short-term funding requirements. The commercial banks then pass on the interest rate levied by the central bank to their consumers through interest charges on loans.

This publication forwarded some questions to the Bankers Association of Namibia (BAN) on their comment regarding the increase in the lending rates that commercial banks have been increasing, making the banks richer at the expense of their consumers. But no response since last month.

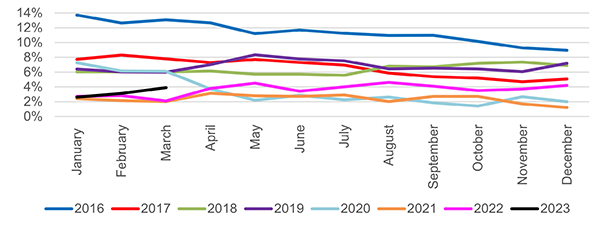

“The household debt servicing costs increased from 9% in 2020 to 17.8% in 2022, reflecting a combination of higher debt levels as well as high-interest rates. Although households are highly indebted, the majority of their debt is secured lending, of which mortgage lending accounts for most of it,” reads the financial report.

The household sector in Namibia accounts for the majority of private sector credit extended (PSCE). It is, therefore, an important participant in the domestic financial system, accounting for almost 58% of total private sector credit extended by the banking sector over the past five years.

The report added that the equity position of homeowners remained in positive territory, as risks to financial stability are less pronounced. However, of concern, the regulators stated, is the growth in unsecured lending, which is, for the most part, consumer spending in nature.

The regulators explained it becomes a financial stability concern when unsecured lending grows significantly because it also speaks to a need for a review of the credit policies of the Domestic Systemically Important Banks (DSIBs) to become more prudent.

In addition, the Covid-19 pandemic hit the Namibian economy while in a recession, thus exacerbating a precarious situation further. As such, household indebtedness will continue to be monitored going forward, while simultaneously establishing whether developments warrant additional macroprudential policy intervention or not.

Both BoN and Namfisa noted that households’ participation in the domestic banking sector stemmed from income supplemented by credit, which boosts consumption and subsequently contributes to economic growth.

On the contrary, rising debt levels under conditions of persistently low economic growth, inflationary pressure and stagnant disposable income, raise concerns about households’ debt-servicing capacity.

“Both the direct and indirect credit exposure by the banking sector to households could have a significant impact on the stability of the banking system and, consequently, pose a risk to domestic financial system stability,” they pointed out.

– mndjavera@nepc.com.na