Namibian taxpayers owe the Namibia Revenue Agency over N$69 billion through capital debts, interest and penalties.

The figure is close to the estimated revenue of N$74.7 billion for the 2023/24 financial year for the national budget, meaning tax payments are a significant revenue source for government, and are able to cover the entire economy.

The Southern African Customs Union (SACU) pool is now considered the main contributor ahead of individual income tax.

Tabling the national budget last month, Finance and Public Enterprises Minister Iipumbu Shiimi said NamRA will continue with the final instalment of the tax arrears’ relief program, whereby interest and penalties will be fully written off if outstanding capital is fully settled by 31 October 2024.

The program will start on 1 April 2023.

“This is the final extension of this program, and we urge all concerned taxpayers to participate before the due date. Afterwards, there will be no more mercy. We encourage those taxpayers with outstanding arrears to utilise the recoveries in their incomes to settle their tax liabilities while the window of relief remains open,” he urged.

NamRA this week shared that with the revised tax amnesty programme, over N$53 billion could be written off. An amount of N$15.2 billion is owed as capital debt, interest amounts to N$11.4 billion and penalties N$42.5 billion.

Over the first six months of the Modified Electronic Filing Tax Relief Programme, a total of N$747 million was collected from the recovery of outstanding tax arrears. This is an addition to the N$1.3 billion collected from the initial Electronic Filing Tax Relief Programme which ended on 31 January 2022.

Shiimi maintained the stance that the economy as well as individual and corporate balance-sheets have not yet sufficiently recovered to warrant the consideration of new tax policy proposals. Increasing the tax burden at this juncture, he said, stands the risk to stifle economic recovery and compromise the emerging growth prospects.

“Accordingly, in the near-term, we will focus our efforts on tax administration reforms to ensure revenue enhancement through adequate tax compliance. In the area of tax policy and tax administration reforms during the medium-term expenditure framework (MTEF), focus will be placed on the implementation of measures to provide some relief to taxpayers in the near to medium-term,” he added.

(Tax)

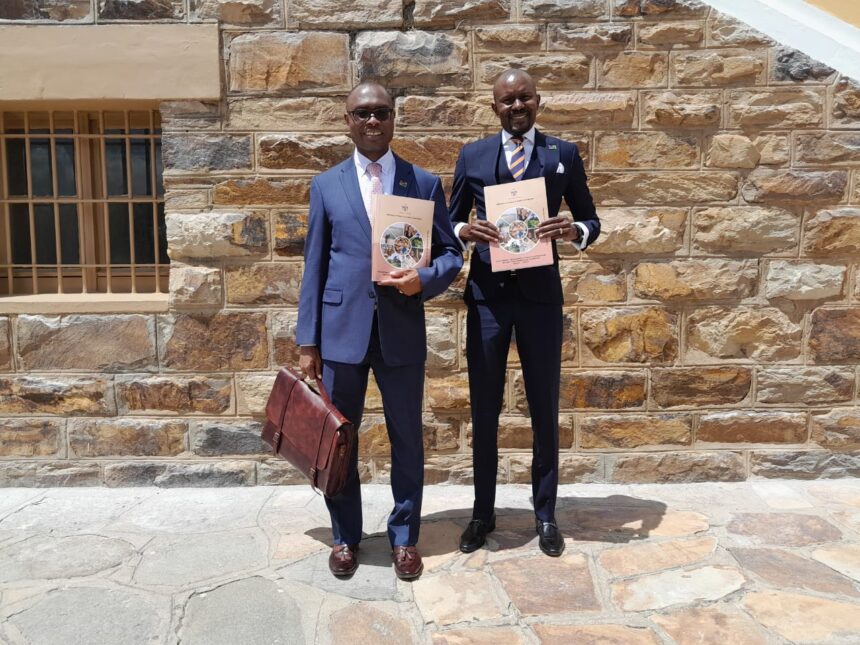

Caption: Taxmen… Finance minister Iipumbu Shiimi and NamRA commissioner Sam Shivute.

Photo: Emmency Nuukala