Government, through finance minister Ericah Shafudah, has reiterated it is not considering any drastic expenditure cuts.

She said such cuts would have severe and lasting implications on the livelihood of society, as most of the expenditure goes to social spending.

Instead, government is implementing policy and structural reforms in the long term to place the economy on a sustainable growth path and increase capacity to create economic opportunities.

These reforms include an economic diversification strategy, resource mobilisation, modernisation of public finance management, and upscale investment in green and sustainable industries.

“If we do that (cut expenditure), it will reverse the gains that we have already achieved in the fight against poverty. However, the government will seek efficiency in spending to make sure money is spent on social projects with high returns and leakages are eliminated,” Shafudah stated.

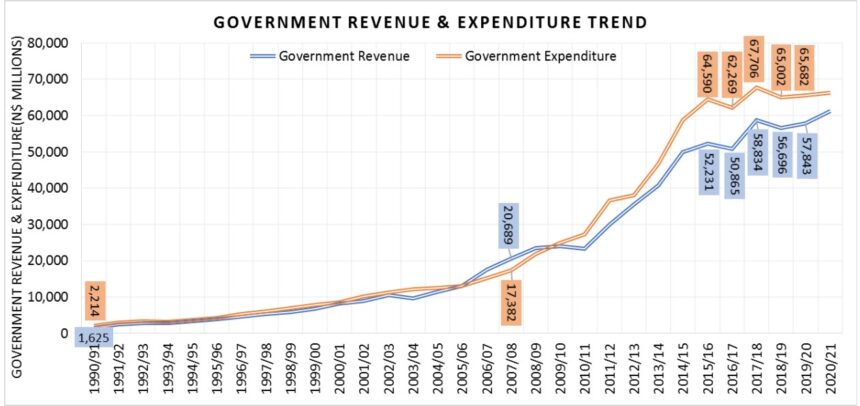

Total expenditure for the current financial year consists of N$79.8 billion in operational expenditure, N$12.8 billion in development expenditure, including N$3.2 billion in development projects funded through external loans and grants, as well as N$13.7 billion in interest payments.

In addition, to continue addressing infrastructure bottlenecks that Shafudah said weigh against Namibia’s growth potential, the development budget has increased by 22.6% to N$12.8 billion from the revised estimates for the financial year 2024/25.

This is inclusive of N$3.2 billion in projects financed outside the State Revenue Fund.

As a ratio of gross domestic product (GDP), the development budget is equivalent to 4.6%, which is an improvement from 4.2% recorded last year. Tabling the 2025/26 Appropriation Bill, Shafudah said her budget was a commitment to the continuous pursuit of fiscal sustainability to ensure domestic public finances are sustainable over the long term. Responding to queries from Inside Business, she stated that the principal objective of Namibia’s tax policy is not to reduce debt but to mobilise resources needed to advance economic growth and development.

Hence, the tax policy measures announced in the budget are not targeting debt reduction but are necessary tools to promote economic growth and the social welfare of citizens.

The finance ministry implements policy and structural reforms to create a business-friendly environment where Namibia’s private sector can grow and prosper.

This ensures the tax policy is fair and not punitive to allow the private sector to reinvest in the economy.

Shafudah continued: “The government has small and medium enterprises programmes in place, such as the SME financing strategy, that needs only to be strengthened going forward. The government, as announced by Her Excellency the President, is developing the Youth Development Fund. This is in addition to many programmes offered by our development institutions, such as the Development Bank of Namibia and Agribank. Government further reformed public procurement to benefit the SMEs and local business, where they get preferences in public procurement”.

In addition, the ministry has introduced a new reduced corporate tax rate for SMEs at 20% for these small and medium enterprises to reinvest more into their business.

“In the short-term, government implements a fiscal consolidation policy, where savings are realised on scaling down of identified spendings, and implementation of reforms as highlighted in the budget statements, where efficiency gains can be realised through the elimination of wastages while optimising on the tax compliance measures,” the minister stated.

When Shafudah tabled the national budget earlier this year, she signalled a substantial increase in government spending, particularly toward developmental projects.

This surge in funding aims to accelerate key projects across the nation, fostering economic growth and improving public services.

– ebrandt@nepc.com.na