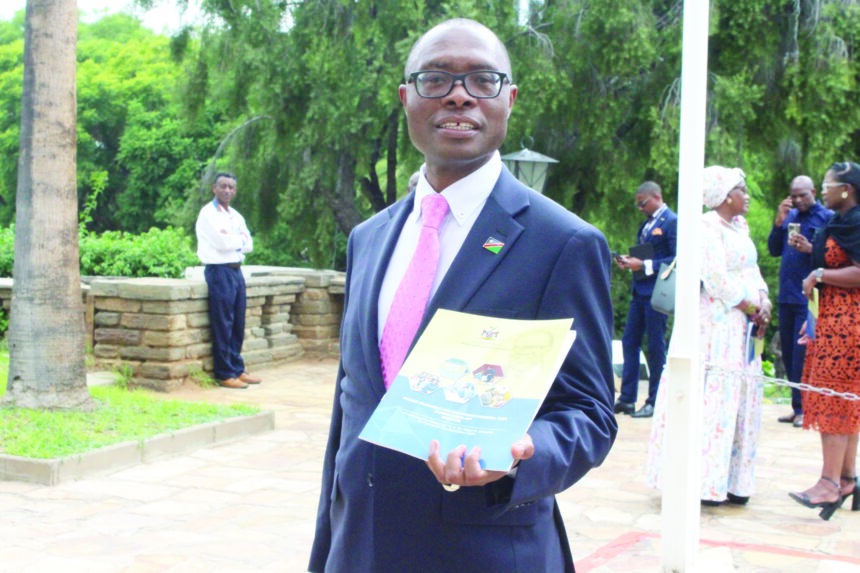

The Minister of Finance and Public Enterprises, Iipumbu Shiimi, has dismissed concerns among some businesses regarding the impact of the government directive on tax refunds, asserting that it will not lead to their collapse.

Parliament has passed the Income Tax Amendment Act, 2024 (Act No. 4 of 2024), which provides for Pay-As-You-Earn (PAYE) deduction reimbursements from 01 March 2024 to 30 September 2024.

The ministry has issued a General Notice (09/2024) granting authority and directing employers to reimburse the PAYE over-deducted from employees by deducting the reimbursed PAYE from the monthly employee tax amount to be paid to the Namibia Revenue Agency (NamRA) between 01 October 2024 and 28 February 2025.

In a ministerial statement on Tuesday, Shiimi differed with the concerns raised by a business forum that refunding employees will place a financial burden on them, especially on small businesses.

“I would like to dispel the misconception that the directive for employers to refund PAYE could force businesses to close down. There is no truth in such an assertion.

The ministry is requesting employers to deduct the PAYE reimbursements from the employee tax to be paid to NamRA. As such, on a net basis, there are no cash- flow implications for employers,” the minister said.

Shiimi said the ministry noted that there could be instances where employers do not have sufficient tax-payable liabilities to effect the full PAYE reimbursements to all employees in a single month.

As a result, the ministry did not prescribe a period within which employers should process the refunds.

“We trust employers will determine the reimbursement period following a comprehensive assessment of their respective monthly cashflows, payroll size

and systems, as well as their internal operational and administrative procedures.

“We, therefore, encourage employees to engage their respective employers for confirmation of the specific dates when they will be in a position to process their refunds,” he said.

The Income Tax Amendment Act pertains to the increase of the threshold for individual income tax from N$50 000 to N$100 000.

The adjustment effectively means that all individual taxpayers will be exempted from paying tax on the first N$100 000 of their income.

As such, there has been an over-deduction of PAYE from all employees earning annual income above N$50 000 over the seven-month period from 1 March 2024 until 30 September 2024, according to Shiimi.

-Nampa