The domestic microlending sector loan book value has shown a notable increase, reflecting a shift in borrowing trends and preferences among consumers. As of the end of 2023, the value of the domestic loan book grew by 6.1% year-on-year, reaching an impressive N$7.2 billion. This growth is primarily attributed to term lenders, whose loan value amounted to N$6.9 billion, representing approximately 96% of the total loan book.

The latest figures were released by the Namibia Financial Institutions Supervisory Authority (Namfisa) last week in their 2023 annual report, which noted that despite the overall growth in the loan book’s value, there has been a decline in the number of borrowers.

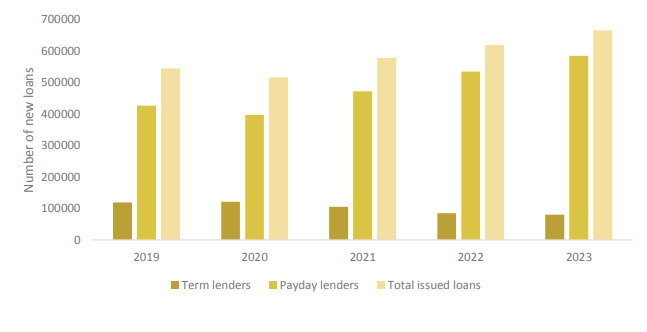

The cumulative number of household borrowers decreased by 9.3%, totalling 221841 beneficiaries by year-end. This decline was evident across both payday and term lenders. Specifically, borrowers using payday loans dropped by 25.8%, while those borrowing from term lenders saw a slight decrease of 0.7%. At the close of 2023, term borrowers still outnumbered payday borrowers within the total household borrower pool.

Payday borrowers are individuals typically seeking short-term loans designed to cover immediate expenses until their next payday. Payday loans are often used for urgent financial needs, while term borrowers take out loans with longer repayment periods, which can range from several months to several years.

The Namfisa report added that term lenders have consistently offered higher average loan amounts, compared to payday lenders. In 2023, the average loan amount from term lenders was N$30 297, while payday lenders provided significantly smaller loans, averaging N$2 584.

This disparity highlights the different target markets and borrowing needs that each type of lender serves. Notably, both lending categories adhere to the legislative requirement that loan disbursements should not exceed N$100 000.

Namfisa added that the cumulative number of household borrowers benefiting from microlending transactions increased by 3.5% y/y by the end of the first quarter of 2024, reaching a total of 224 124. This growth was primarily observed among borrowers using term-lending. Additionally, term-borrowers continued to outnumber payday borrowers at the end of the reporting period.

Namfisa is an independent institution established to regulate and supervise institutions in the financial services’ industry in the public interest. The authority is fully-funded by levies imposed on this industry.

This month, Popular Democratic Movement parliamentarian Inna Hengari moved a motion to discuss and find a lasting solution to the mushrooming “backyard loan sharks”, and their clients’ inability to escape the debt trap.

She said lending institutions make vast profits, while ordinary people, mostly civil servants, are consistently drowning in debt.

“The growing debt crisis among Namibians, particularly civil servants, is a matter of urgent concern. Many are struggling to repay loans, which is not only a personal burden, but a threat to the wider economy. When a significant portion of the population is in debt, it weakens the entire financial system,” she cautioned. -mndjavera@nepc.com.na