The Namibian economy is expected to slow down marginally in 2025, with output constrained by weaker activity in manufacturing and primary industries, before gaining momentum next year.

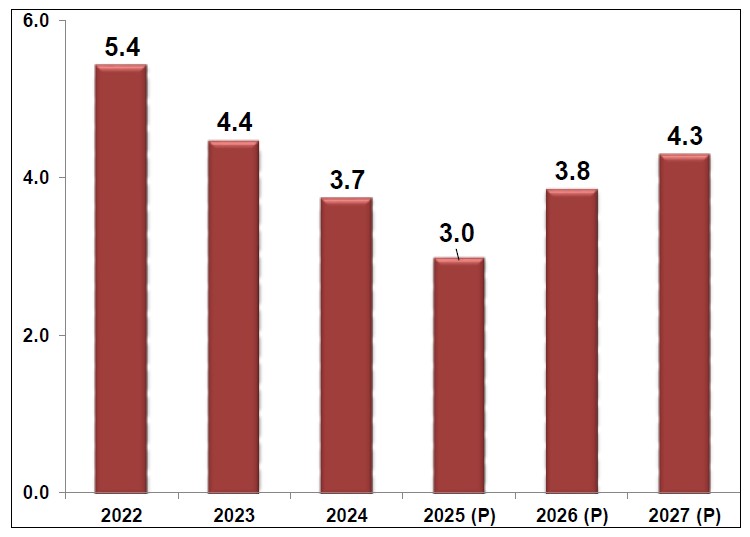

The latest figures from the central bank indicate the country’s real GDP growth should moderate to 3% in 2025, from 3.7% in 2024,

The Bank of Namibia’s (BoN’s) Economic Outlook update for December 2025 indicates the domestic economy is estimated to regain acceleration to a 3.9% growth in 2026.

Compared to the Bank of Namibia’s August 2025 Economic Outlook, the current projections represent a downward revision of 0.5% points on GDP growth for 2025, reflecting a weaker outlook for the manufacturing sector.

The central bank’s Economic Outlook, released on Friday, elaborates that the 2025 slowdown is primarily driven by a contraction in manufacturing, where output is estimated to decline by 4.6% in 2025 following moderate growth of 2.8% in 2024.

“This decline stems mainly from sharp public contractions in basic non-ferrous metals, meat processing, and diamond processing subsectors, with the latter normalising after an exceptional performance in 2024. Similarly, activity in the primary industries is expected to remain weak, with overall output estimated to contract marginally by 0.1% in 2025, largely due to significant declines in livestock farming and continued weakness in diamond mining. The combined effect of these developments, alongside persistent drought conditions and tepid global demand, is expected to weigh on short-term growth prospects,” stated BoN spokesperson, Kazembire Zemburuka.

The statement issued on Friday continues that the domestic economy is vulnerable to substantial downside risks, specifically diminished diamond export earnings, driven by price pressures and the rise of lab-grown alternatives, which pose a significant threat.

“Furthermore, potential trade disruptions stemming from protectionist trade policies and inflationary pressures arising from ongoing global conflicts could reduce demand for Namibia’s export commodities.

Moreover, the combined effects of declining SACU and diamond revenues could lead to rising debt sustainability risks, potentially necessitating expenditure rationing to restore fiscal space,” the central bank stated.

Meanwhile, BoN expects Sub-Saharan African growth to remain stable in 2025 before improving in 2026. The central bank’s outlook expects Sub-Saharan Africa growth to remain at 4.1% in 2025, unchanged from 2024, before improving to 4.4% in 2026 as adverse impacts of prior weather shocks subside and supply constraints gradually ease.

“The latest projection for 2025 and 2026 largely reflects improved growth in Nigeria due to robust domestic support from increased oil production, greater investor confidence, and a supportive 2026 fiscal stance. This positive revision contrasts with the significant downward adjustments seen in many peer economies, which are highly exposed to the adverse changes in the international trade and official aid landscape, unlike Nigeria, which has limited exposure to US tariffs,” BoN stated.

On the global front, BoN anticipates economic growth to decelerate in 2025.

“The world’s real GDP growth is projected to slow from 3.3% in 2024 to 3.2% in 2025 and further to 3.1% in 2026. According to the IMF’s October 2025 World Economic Outlook (WEO), anticipated moderate growth is primarily due to the prevailing forces of protectionism and intensified uncertainty. However, the tariff shock is smaller than originally anticipated. Despite this, the projected rate of global growth for 2025 has been revised upward by 0.2% points, while the growth forecast for 2026 was maintained at the level reported in the July 2025 WEO (World Economic Outlook) update,” BoN stated.

In addition, advanced economies are projected to register stagnant growth throughout 2025 and 2026, remaining steady at 1.6% in 2025 and 2026 on the back of slow demand and subdued consumption growth across all key jurisdictions.

-ebrandt@nepc.com.na