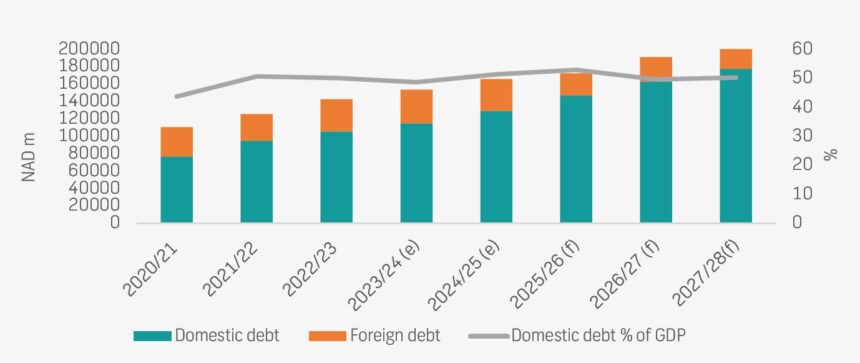

Namibia’s total debt stock is projected to reach N$172 billion during this financial year.

This represents 62% of gross domestic product (GDP), down from 66% of GDP last year.

Although still higher than preferred, this level of national debt can be sustainable if properly managed.

However, revenue risks, coupled with interest rate projections, could potentially derail efforts to reduce both the budget deficit and public debt, analysts say.

When she tabled the national budget last week, finance minister Ericah Shafudah said the government budgeted N$13.7 billion to meet statutory debt servicing obligations, equivalent to 14.8% of revenues and 4.9% of GDP.

“We remain concerned that we expend more resources on debt servicing than we plough back into the economy to grow our economic potential through the development budget. As such, there is a need for continued measures to contain the pace of debt accumulation to curb the rising debt servicing costs. We are, therefore, committed to maintaining public debt on a reduction path and ensuring that debt is raised most cost-effectively,” said the minister.

She expressed confidence that an envisaged funding approach will stabilise the debt stock over the medium-term.

Shafudah noted that after settling hard currency obligations, over 80% of the country’s debt stock will be denominated in the domestic currency and thus insulated from exchange rate risks.

“We believe domesticating our debt portfolio will strengthen the domestic capital markets while providing an avenue for deploying domestic capital in the domestic economy,” she stated.

On balance, the finance ministry aims to achieve a positive primary budget balance of 0.3% of GDP during the current financial year.

Subsequently, the budget deficit is projected at N$12.8 billion in nominal terms, equivalent to 4.6% of GDP.

“In the interest of pursuing fiscal sustainability and debt stabilisation, we aim to maintain a primary surplus and consequently the budget deficit at an average of 4% of GDP over the MTEF,” said the minister.

Last week, Bank of Namibia governor Johannes !Gawaxab cautioned that the prospect of global trade disruptions arising from geopolitical tensions, alongside potential inflationary pressures, presents a considerable challenge.

“Adding to these concerns, fiscal pressures resulting from declining Southern African Customs Union (SACU) and diamond revenues could lead to unsustainable debt levels, potentially necessitating substantial expenditure reductions,” he warned.

Commentary

Former presidential economic advisor and previous CEO of the Development Bank of Namibia John Steytler feels Namibia’s debt situation is quite precarious.

His key concern is the huge amounts of money spent on debt servicing.

He believes that to ensure sustainability, there must be a holistic approach.

“Firstly, we must grow the size of the economy. Secondly, we must look at expenses – and where possible, cut wasteful expenditures. Thirdly, we must increase revenue collection,” Steytler commented.

He added that it is very important to establish an intentional and collaborative effort between government, private sector and all relevant stakeholders on the importance of debt sustainability.

Meanwhile, economics lecturer Mally Likukela pointed out that while the debt-to-GDP ratio remains an important indicator, it is susceptible to swings in GDP as a denominator, which he stated could give misleading outlooks.

“The fact that it shows a slight slowdown does not mean an improvement because the debt stock remains high. The key issue of concern, which is the debt service cost, remains elevated even when the ratio gets smaller, as it does not get cheaper in line with the ratio,” he noted.

Another way of looking at Namibia’s debt stock, he stated, is to look at the debt stock in terms of per capita.

“This N$172.4 billion translates to approximately N$57 000 per person per year when put against the population. That means every citizen owes this amount at the current three million population of Namibia,” Likukela warned.

Also weighing in, analyst Josef Sheehama stated that despite Namibia’s debt-to-GDP ratio being higher than the standards or benchmark, 66% is still sustainable if it is used for development projects to boost economic growth rather than for consumption.

This would raise financial strain and the risk of financial distress as well as high-interest debt repayment.

Sheehama said going forward, Namibia must prioritise local content policies and economic structural reforms, particularly in sectors like manufacturing and agriculture.

Klaus Schade, also an economist, pointed out that the debt stock of 66% projected for FY2025/26 is higher than anticipated in the mid-year budget review of October 2024.

“This is due to a higher budget deficit, caused by significantly lower revenue from SACU and diamond royalties. The current debt stock remains high, but is manageable, as long as our revenue forecast materialises. There are, however, risks to the revenue as well as interest rate projections that could derail the attempts to reduce the budget deficit as well as public debt.

“The risks include the introduction of tariffs on imports by the United States of America (USA), the likely non-renewal of the Africa Growth and Opportunity Act (AGOA), as well as potential upward pressure on interest rates in the USA,” Schade stated.

Commenting on the recent tabling of the budget, FNB analysts noted that the debt composition is expected to remain highly concentrated in domestic debt, reflecting the planned Eurobond repayment in October 2025.

In their analysis, FNB Namibia economists Cheryl Emvula and Helena Mboti stated that the finance ministry outlined the Eurobond redemption plan for 2025.

US$463 million has been accumulated in the Sinking Fund over the past financial years.

This means an additional N$3 billion is expected to be added during the current financial year, leaving a balance of N$2.3 billion to be refinanced through the domestic market.

In addition, N$2 billion of this year’s SACU receipts will be directed into the Sinking Fund as per the previous minister’s commitment.