Stock brokerage Simonis Storm (SS) projects that with stable consumption spending, the domestic economy could experience a more balanced inflationary environment, which would in turn foster sustainable economic growth for the remainder of the year.

This is as the domestic annual inflation rate continues to ease more rapidly than anticipated.

SS has maintained its forecast of an average domestic inflation rate of 4.9% for 2024.

“These insights suggest a complex but cautiously optimistic economic outlook for Namibia. While the easing of inflation in essential goods is a positive development, the rising costs in services and transportation highlight the need for vigilant economic management,” SS said in its latest inflation analysis.

“Economic data reveals a mixed domestic inflationary landscape, characterised by notable easing in essential categories, alongside rising costs in sectors such as services and transportation,” SS said.

Meanwhile, SS pointed out that the first half of 2024 experienced a slower domestic inflationary period, averaging 4.9% year-on-year (y/y), compared to 6.5% y/y during the same period in 2023.

The report noted that “specifically in the second quarter of 2024, inflation decelerated to 4.8% y/y, down from an average of 5.0% y/y in the first quarter, and significantly lower than the 5.9% y/y recorded in the second quarter of 2023”.

Looking at zonal inflation in Namibia, Zone 1 (northern regions) and Zone 2 (Khomas region) both reported inflation rates of 4.8% y/y, slightly above the national headline inflation rate. In contrast, Zone 3 (Hardap, ||Kharas, Omaheke and Erongo regions) recorded a lower inflation rate of 4.1% y/y, falling below the headline inflation rate.

Namibia’s real consumption spending increased to N$33.6 billion in the first quarter of 2024, up from N$29.7 billion in the same period of 2023, but down from N$35.2 billion recorded in the fourth quarter of 2023.

According to SS, this represents a 13.4% y/y increase, yet a quarterly decline of 4.5%. “Looking ahead, we anticipate consumption spending to stabilise, which could support a continued moderation in inflation across certain categories of the NCPI,” SS stated.

Meanwhile, the central bank’s inflation forecast for June 2024 indicates domestic annual headline inflation increased to 4.9% in May 2024, translating into a 0.3 percentage point increase in the consumer price index (CPI) on a monthly basis.

Bank of Namibia figures show the biggest contributors to the annual inflation rate were the transport (1.2 percentage points), food and non-alcoholic beverages (0.9 percentage points), alcoholic beverages and tobacco (0.9 percentage points), and housing, water, electricity, gas and other fuels (0.9 percentage points) categories.

The inflation rate for food and non-alcoholic beverages decelerated significantly from June 2023 to June 2024, dropping from 11.7% y/y to 4.3% y/y. SS said this indicates a notable easing in price pressures for essential food items such as bread, cereals, meat, fish and vegetables.

“However, oils and fats slightly increased in June 2024, following a deflationary trend over the past three months. Recreation and culture experienced a moderate slowdown in inflation, declining from 10.1% y/y in June 2023 to 6.7% y/y in June 2024,” SS said.

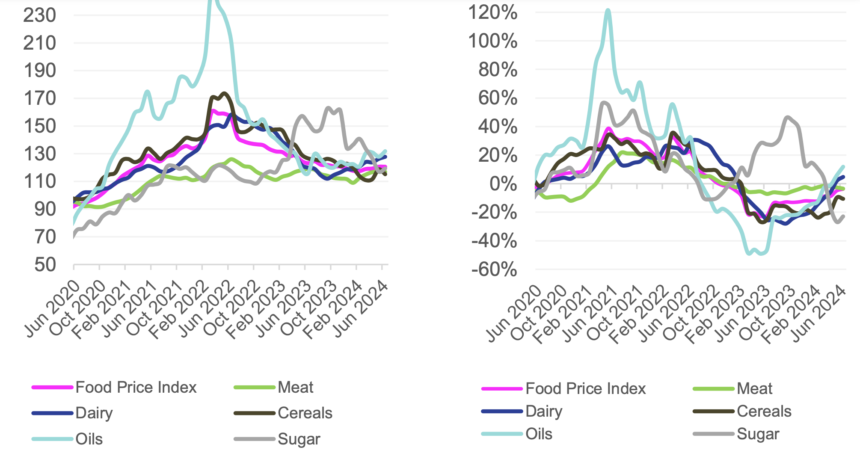

In June 2024, the Food and Agriculture Organisation’s Food Price Index stood at 120.6 points in nominal terms, unchanged from May, but down 3.8% y/y from a year ago in real terms. SS pointed out that the cereal price index averaged 115.2 points, reflecting a 3% drop from May 2024, and a 10.6% decrease from June 2023.

“This decline was driven by lower global export prices for wheat, maize, barley and sorghum due to improved production prospects and ongoing harvests,” SS noted.