Edgar Brandt

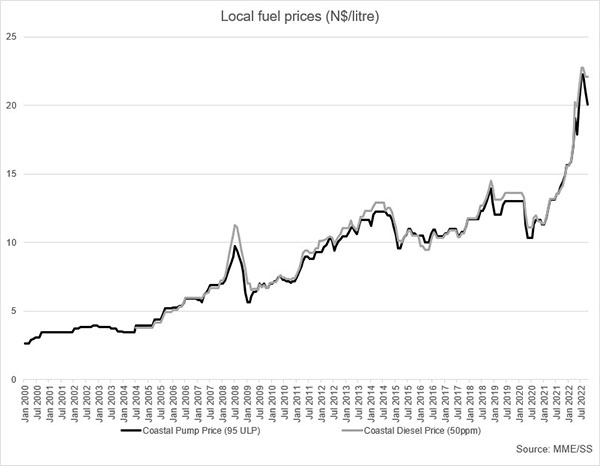

After receiving numerous queries from the Namibian public as to why domestic diesel prices were left unchanged for October, the energy ministry explained this is due to under recoveries (losses) recorded on diesel fuel sold locally.

According to ministry spokesperson, Andreas Simon, global demand for diesel has increased, which in turn pushed up the international price of diesel. This increased demand has been exacerbated as winter commenced in Europe.

“In fact, diesel prices were supposed to go up due to the under recovery but the ministry saw it fit to keep prices unchanged,” Simon stated.

Diesel has long been popular in Europe mainly due to tax policies that made diesel less expensive than petrol. Europe is heading into winter with seasonally low levels of diesel in storage tanks, with major implications for the continent’s industries and drivers in the run-up to EU sanctions on Russian crude oil and refined product supplies.

Diesel, along with other distillate fuels such as heating oil and gas oil, are the lifeblood of many European industries with uses ranging from powering factories to heating homes, in addition to being used as a motor fuel.

Meanwhile, Simon noted that the reinstatement of the Road Fund Administration and Motor Vehicle Accident Fund levies, which were discontinued several months ago to help push down local fuel prices, is also a contributing factor.

He added that the ministry continues to monitor the international oil market, particularly the proposed Organisation of Petroleum Exporting Countries (OPEC) decision to cut production outputs, which he warned could result in price hikes in the near future. Yesterday’s OPEC meeting will be the organisation’s first in-person meeting since 2020.

Yesterday, international oil prices had changed minimally ahead of the OPEC+ producers meeting today to discuss a significant cut in crude output after gaining more than 3% in the previous session.

Yesterday’s Brent crude price was up one cent at US$91.81 a barrel after climbing US$2.94 in the previous session. US West Texas Intermediate (WTI) crude futures fell nine cents, or 0.1%, to US$86.43 a barrel after gaining US$2.89 a day earlier.

OPEC and allies led by Russia, together called OPEC+, were scheduled to meet yesterday in Vienna to discuss output cuts of up to two million barrels per day (bpd).

On Tuesday, international oil prices rose on output cut expectations. Tuesday’s Brent crude was up 64 cents, or 0.7%, to US$89.50 a barrel after gaining more than 4% in the previous session.

Moreover, oil industry experts believe some OPEC members could enforce voluntary output reductions in addition to the overall organisational cutbacks. This has the potential to make the expected production cut the largest since the start of the Covid-19

pandemic.

According to reports, Kuwait’s oil minister said OPEC+ would make a suitable decision to guarantee energy supply and serve the interests of producers and consumers.