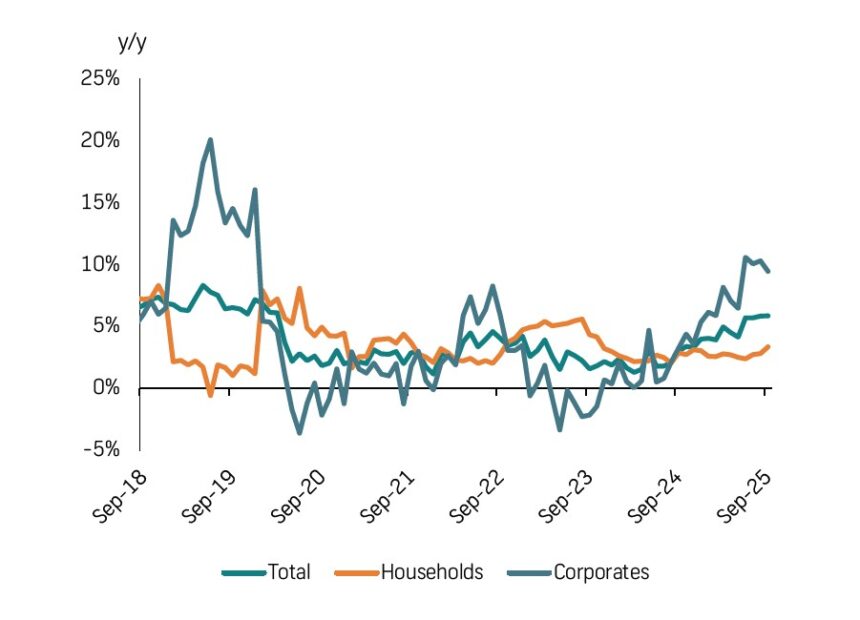

Namibia’s Private Sector Credit Extension (PSCE) growth is expected to remain positive, driven by corporate credit as household borrowing remains subdued.

One of the key indicators of economic health, a growth in PSCE usually signals an increased demand for goods and services.

“Credit growth rose to 5.9% year-on-year (y/y) in September 2025 from 5.8% y/y observed a month ago, driven by corporate lending despite a slowdown to 9.5% y/y. Meanwhile, household credit improved slightly to 3.4% y/y. PSCE growth was supported by increases in growth in instalment and leasing credit (18.8% y/y) and other loans and advances (10.3% y/y). Contrarily, overdraft and mortgage credit contracted, slowing the overall PSCE growth for the month,” commented FNB Namibia economist Cheryl Emvula. In its breakdown of the most recent PSCE figures, compiled by Emvula graduate analyst Ndateelela Amukuhu, FNB notes that the credit environment shows continued signs of diverging growth paths, with most of the growth observed in corporate lending, as household credit remains constrained.

“Across credit categories, PSCE growth was mainly supported by increases in other loans and advances, as well as in instalment and leasing credit. Growth in other loans and advances accelerated to 10.3% y/y in September compared to 9.4% seen a month ago, with household driving growth in the category as corporate credit appetite remained relatively weak. Instalment and leasing credit further supported the overall growth, rising by 18.8% y/y in September from 17.5% y/y recorded a month ago,” FNB stated.

In terms of household credit, FNB pointed out that mortgage credit remained subdued, with growth slowing to 0.6% y/y in September from 0.8% y/y in August.

“This persistent weakness continues to reflect ongoing housing supply constraints and generally weak household purchasing power, which continue to limit mortgage uptake,” FNB stated.

FNB’s analysts added that corporate credit is likely to remain the primary driver, with household borrowing continuing to face structural constraints such as high levels of unemployment and housing dynamics. “These structural constraints are expected to weigh on household credit. Even with the recent policy rate cut, the impact on overall PSCE growth is likely to be limited,” FNB stated.

Also weighing in, financial services firm Simonis Storm (SS) noted that PSCE growth was supported by resilient corporate borrowing in mining, manufacturing and agriculture, alongside a modest but steady recovery in household credit.

In its report compiled by economist Almandro Jansen, SS said it expects PSCE growth to surpass 6% y/y in Q4 2025, underpinned by three reinforcing dynamics.

These are lower lending rates and improved affordability, sustained corporate investment activity as well as gradual household recovery.

“However, the October 2025 Eurobond redemption introduces a short-term liquidity adjustment that could temporarily affect domestic credit dynamics. With local banks participating in funding the US$750 million repayment, some liquidity that would typically support household and corporate lending is being redirected toward government financing. This may cause a mild crowding-out effect in the final quarter. Nonetheless, credit activity is expected to normalise early in 2026, once Southern African Customs Union receipts and export inflows replenish banking system liquidity,” SS stated. Overall, the firms maintain a constructive PSCE outlook for the remainder of 2025. -ebrandt@nepc.com.na