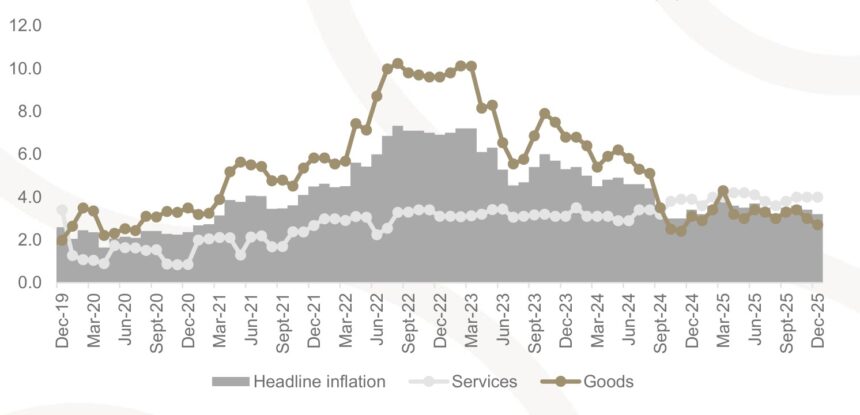

Domestic headline inflation eased to 3.2% year-on-year (y/y) in December 2025, down from 3.4% in November and 3.4% a year earlier. For the entire 2025, Namibian inflation averaged 3.5%, which is the same figure recorded during the 12-month average from January 2024 to December 2025.

Commenting on the latest inflation numbers from the Namibia Statistics Agency (NSA), local financial services firm Simonis Storm (SS) pointed out that while inflation is expected to edge higher in 2026, the outlook remains benign and well within the central bank’s target range.

In its most recent report on inflation, SS analyst Almandro Jansen stated that price pressures are expected to be driven largely by structural and service-related factors, rather than by broad-based demand or imported inflation shocks.

Looking ahead to 2026, SS expects inflation to tick slightly higher, averaging around 3.6%-3.8%, reflecting a normalisation rather than a deterioration in price dynamics. SS expects housing and utility-related inflation to remain resilient, underpinned by further tariff adjustments, high construction input costs, and persistent supply-demand imbalances in rental markets.

SS further anticipates services inflation to remain firm, particularly in education, healthcare, and personal services, while they expect core inflation to remain anchored but elevated relative to headline inflation.

“In this context, inflation is expected to remain contained and manageable from a monetary policy perspective. Given this backdrop, the inflation outlook provides the Bank of Namibia with room to ease monetary policy further in support of economic activity, without jeopardising price stability. We expect the BoN to implement two 25 basis-point repo rate cuts in 2026, bringing the policy rate down to 6.00%”, Jansen states in the report.

He added that the inflationary easing cycle is likely to be gradual and data dependent, aligned with South Africa’s policy trajectory and contingent on inflation expectations remaining anchored.

“Overall, the balance between contained inflation and a still-fragile domestic recovery supports a measured easing bias in 2026, aimed at stimulating credit growth and investment while preserving macroeconomic stability”, Jansen added.Meanwhile, during 2025, headline inflation eased through the second half of the year, closing December at 3.2% y/y, down from June 3.7%, and remained comfortably within the Bank of Namibia’s 3% to 6% target range.

SS pointed out that monthly price movements were generally subdued outside of episodic utility and tariff adjustments, underscoring a broadly stable inflation environment.

“Beneath the headline, however, price pressures became increasingly concentrated in housing, utilities, education, and transport, reflecting structural constraints rather than demand-driven overheating. Housing, water, electricity, gas and other fuels remained the most persistent source of inflation in 2025, driven by slow land servicing, limited housing supply, recurring municipal tariff adjustments, and elevated construction and maintenance costs,” Jansen added.